Lesson 1

Introducing the XRP MPT (multi-purpose token) standard

A next-generation token standard for compliant, efficient, RWA tokenization.

Business professionals and financial institutions worldwide are increasingly looking to blockchain technology to unlock new efficiencies through asset tokenization. Yet many still struggle to find the right balance between robust compliance and the benefits of a decentralized, public network.

The XRP Ledger (XRPL) has long been trusted by developers and institutions alike for its reliability, low cost, and built-in financial features. Now, with the introduction of the Multi-Purpose Token (MPT) standard, the XRPL takes tokenization to the next level. MPTs are designed to help institutions issue and manage tokenized assets with native tools for compliance, control, and flexibility, all while eliminating much of the complexity traditionally handled through smart contracts.

Why a New Token Standard Matters

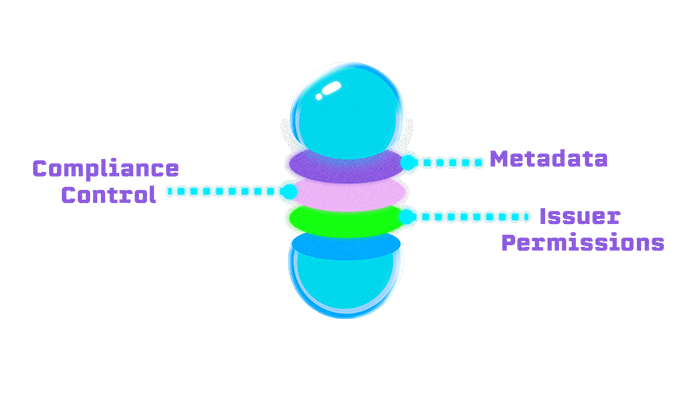

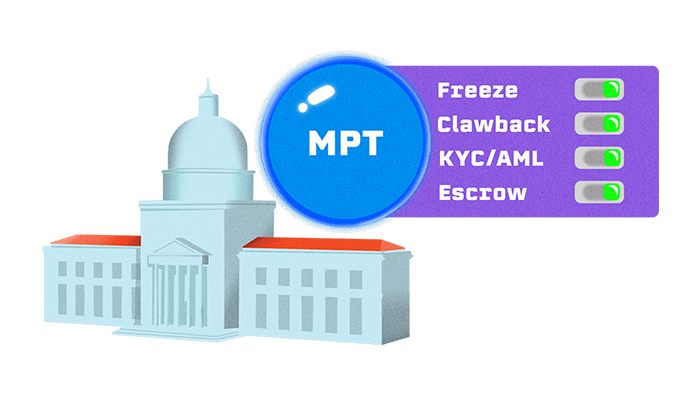

In traditional tokenization, especially on networks like Ethereum, critical features like transfer restrictions, KYC/AML compliance, or clawbacks often require custom smart contracts. This approach increases cost, risk, and development time — and it can make audits more complex. The MPT standard on XRPL solves this by baking key features directly into the token’s definition. This means rich metadata, precise issuance controls, authorization flags, and compliance functions like Freeze and Clawback are all native to the token itself. As a result, institutions gain the robust, permissioned control they need — while still leveraging the scalability, performance, and low transaction costs of a proven public blockchain.

This all-encompassing, built-in design of MPTs dramatically reduces friction throughout the asset lifecycle. For example, an issuer could freeze a compromised wallet’s balance, reclaim tokens if legally required, or restrict trading to authorized accounts, all without deploying new contracts. Additionally, MPTs support rich metadata. This means each token can link to detailed documentation, legal disclosures, and/or asset identifiers — enhancing convenience and transparency for marketplaces, regulators, and investors alike. Compared to older standards like Ethereum’s ERC-20, MPTs offer faster transaction speeds (3-5 seconds on XRPL), ultra-low fees, and higher scalability, making them practical for real-world financial instruments like tokenized bonds, stablecoins, or money market funds — not to mention other RWAs (e.g., physical assets) being tokenized.

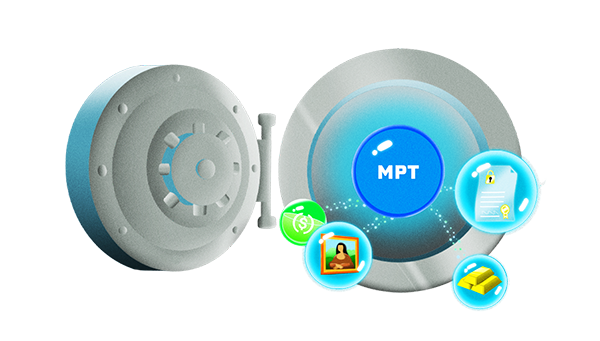

MPTs are already opening up new possibilities for tokenizing a wide range of real-world assets. A bank might issue a corporate bond as an MPT, embedding coupon rates and maturity dates directly into the token’s metadata. Only KYC-approved investors could hold or trade the bond, with secondary market activity happening securely on XRPL’s native decentralized exchange (DEX). Features like Escrow and Clawback add further flexibility for compliant operations.

From tokenized stablecoins and money market funds to fractionalized real estate, the XRPL MPT standard empowers institutions to build innovative products with fewer barriers and lower operational overhead.

Key Benefits for Entrepreneurs and Institutions

By standardizing how compliance, control, and metadata are handled, MPTs help those involved in tokenization efforts reduce onboarding costs, minimize smart contract risks, and accelerate time-to-market for new products. Issuer security is also enhanced through delegated administration and multi-signature controls — ensuring sensitive actions like freezing or clawbacks require multiple approvals. For developers, the MPT standard’s clear rules make integration simpler and more predictable. For regulators, it provides auditable, protocol-level assurance that KYC/AML and other compliance measures are enforced.

Unlocking the Future of Tokenization on XRPL

As the demand for real-world asset tokenization grows (projections almost uniformly in the trillions of dollars in the coming decade), so does the need for standards that deliver robust compliance without sacrificing the efficiency of public blockchain networks. The XRP Ledger’s Multi-Purpose Token standard is purpose-built for this moment.

Combining a 12-year record of reliability with advanced native features, XRPL and MPTs make it easier than ever for institutions to issue, manage, and trade tokenized assets at scale.

By removing the need for custom smart contracts and offering out-of-the-box compliance tools, the MPT standard unlocks significant ROI for issuers — from faster deployment to reduced operational risk and lower costs. Institutions ready to explore the future of tokenization can look to XRPL and MPTs as the foundation for a more efficient, transparent, and accessible financial ecosystem.