Lesson 3

What is RWA tokenization?

Transforming Real World Assets into Digital Tokens

What is Tokenization?

Tokenization is the process of converting ownership rights to an asset into a digital token on a blockchain. This enables assets like real estate, fine art, stocks, or even collectibles to be represented digitally, making them easier to trade, divide, and manage.

Imagine owning a valuable painting. Traditionally, you would need to sell the entire painting to access its value. However, through tokenization, you can create digital tokens representing ownership, allowing multiple people to hold shares of the painting while preserving its integrity.

Tokenization democratizes access to high-value assets by lowering entry barriers, increasing market efficiency, and enhancing liquidity.

Fungible vs. Non-Fungible Tokens

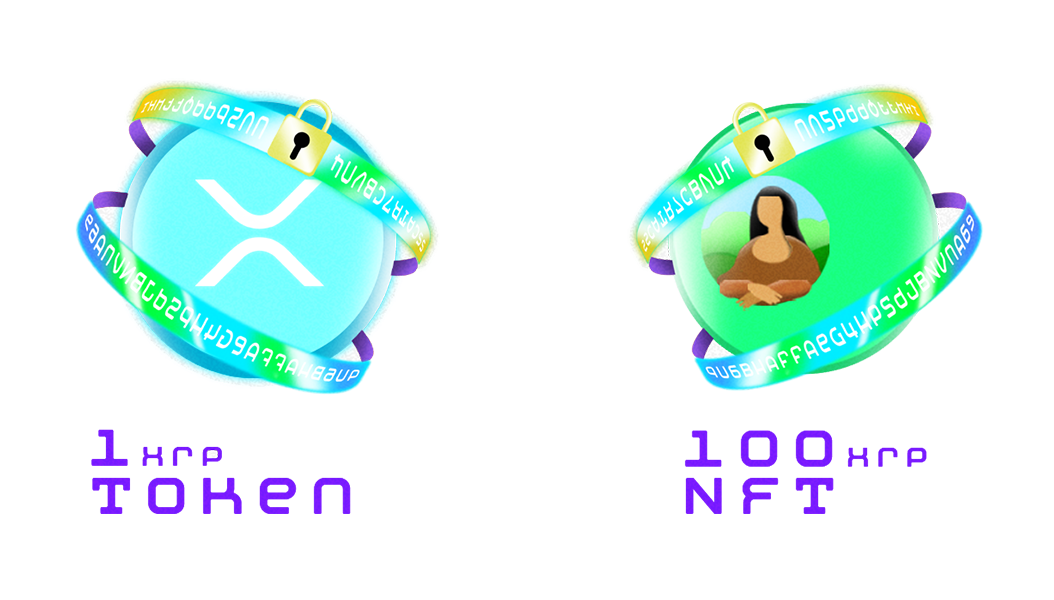

Tokenized assets can be categorized into two types: fungible and non-fungible tokens (NFTs).

Fungible tokens

Fungible tokens are interchangeable, meaning each unit holds the same value. For example, if a painting is tokenized into 100 identical tokens, each token represents an equal fraction of ownership. Each token can be exchanged just like you would with dollars or any other cryptocurrency.

Non-fungible tokens (NFTs)

Non-fungible tokens (NFTs), on the other hand, are unique and cannot be exchanged on a one-to-one basis. If a painting is tokenized as a single NFT, it represents exclusive ownership of that particular artwork, making it distinct from other assets and equally as unique as the artwork it represents.

Fungibility plays a crucial role in how assets are managed and traded

Whether a token is fungible or non-fungible drastically changes how it’s manipulated within the market. While fungible tokens allow for seamless division and exchange, NFTs provide a mechanism for certifying authenticity and uniqueness. Both types of tokens unlock new opportunities for asset ownership, investment, and transferability.

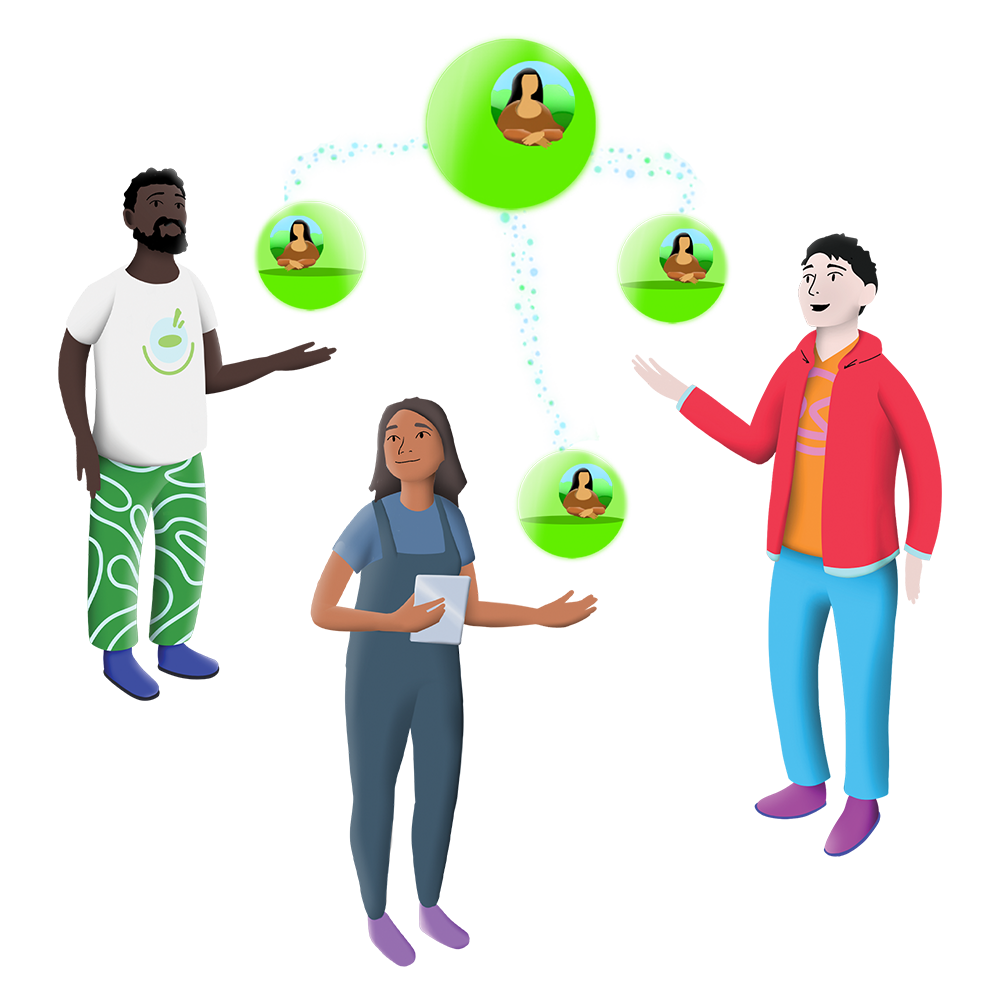

Advantages of Tokenization

Tokenization offers several key benefits:

- Fractional ownership through fungible tokens: Allows investors to buy portions of high-value assets rather than requiring full ownership.

- Increased liquidity: Tokenized assets can be traded more easily, reducing the friction often associated with traditional asset transactions.

- Greater accessibility: More people can participate in investment opportunities that were previously limited to wealthy individuals or institutions. These advantages make tokenization an innovative approach to modern asset management, enabling a more inclusive financial ecosystem.

The Future of Asset Tokenization

As blockchain technology continues to evolve, tokenization is likely to expand across multiple industries, from real estate and fine art to intellectual property and commodities. The ability to digitize and divide ownership of assets will reshape traditional financial systems, offering increased transparency and efficiency.

However, widespread adoption isn’t an easy feat. Before tokenization can flourish, we as society need to agree on regulations, reliable security standards, interoperability between different economic systems, and governments agreeing on trust and transparency practices. With the right frameworks in place, tokenization has the potential to redefine asset ownership and investment in the digital age. These blockers to adoption will be explored in more detail in a later lesson.