Lesson 4

The process of tokenizing real-world assets (RWAs)

The Process of Tokenizing Real-World Assets (RWAs)

Tokenizing real-world assets

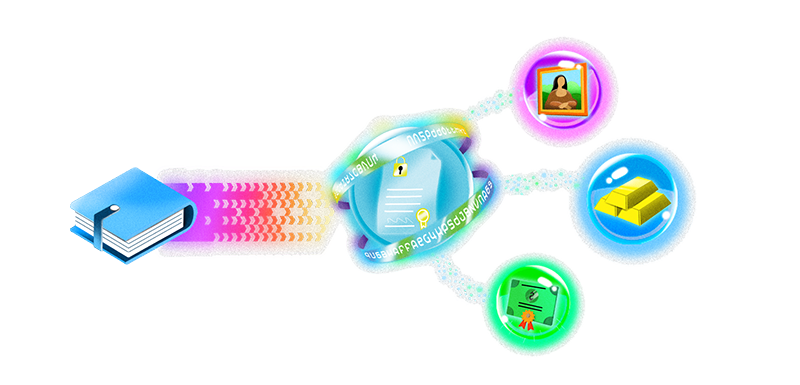

As we discussed in the previous lesson, tokenizing real-world assets (RWAs) is an emerging innovation that bridges traditional finance and blockchain technology. By converting tangible assets into digital tokens, businesses and investors can unlock new liquidity while providing transparency and accessibility to all. The process isn’t easy, requiring careful planning, compliance with regulations, and the use of blockchain infrastructure such as the XRP Ledger (XRPL).

How does tokenizing a tangible, real-world asset work? Imagine a commercial building worth $1 million. Instead of selling it through traditional channels, a company can tokenize real-estate ownership by creating 1 million digital tokens, each representing a $1 stake in the property. This fractionalization enables smaller investors to participate in asset ownership, making investments more inclusive and efficient.

Steps in Tokenizing Assets

The tokenization process involves several key steps:

1. Identify the Asset & Determine Its Legal Structure

- The type of asset (real estate, commodities, securities, etc.) must be clearly defined.

- Legal frameworks determine whether the token represents direct ownership (e.g., a deed) or an investment share.

- CompanyXYZ, for example, might tokenize 100% ownership of a building, issuing 1 million tokens, each representing an equal share of ownership.

2. Establish Compliance (Securities Law, KYC, and Jurisdiction)

- Ensuring compliance with financial regulations is crucial to avoid legal risks.

- Know-Your-Customer (KYC) and Anti-Money Laundering (AML) policies must be implemented.

- Jurisdiction-specific securities laws impact how the tokens can be traded and who can invest.

3. Create and define the Token & Smart Contract

- Using a combination of XRPL native features, metadata and potentially a smart contract via sidechains, is programmed so we can define ownership, transfer rules, and compliance checks.

- The token can be structured to include revenue-sharing models or voting rights for investors.

4. Issue & Manage the Token on XRPL

- We will discuss some specifics / features of this, below.

5. Handle Ownership Transfers & Dispute Resolution

- Transfers occur seamlessly on-chain, with transparent records.

- Smart contracts can enforce automated dispute resolution mechanisms.

Legal & Regulatory Considerations

Tokenization must align with financial regulations to prevent legal complications. Some critical legal aspects include:

Ownership Structure

- Does the token confer direct asset ownership or function as an investment vehicle?

Regulatory Compliance

- Are securities laws being followed in the relevant jurisdiction(s)?

Dispute Resolution

- If ownership is challenged, how will it be resolved on-chain or through legal means?

- Governments and regulatory bodies are actively developing frameworks to accommodate tokenized assets, but compliance remains complex and varies by region.

Smart Contracts & XRPL’s Role in Tokenization

Smart contracts on the XRPL play a fundamental role in the tokenization process. They facilitate:

- Issued Currencies (IOUs): Representing real-world assets on XRPL.

- Trustlines: Managing counterparty risk and establishing trust between issuers and token holders.

- Escrow Features: Enabling secure, automated transactions and compliance enforcement.

XRPL’s efficient, low-cost transactions and built-in compliance mechanisms make it a preferred choice for tokenizing RWAs. Tokenizing RWAs is transforming financial markets by making asset ownership more liquid and accessible. By leveraging XRPL’s robust infrastructure, issuers can ensure compliance, security, and efficiency. However, navigating the legal landscape remains a challenge, requiring thorough due diligence and regulatory awareness.

As tokenization adoption grows, new frameworks will emerge to facilitate smoother processes, further integrating blockchain into mainstream finance.