Lesson 7

Security, custody, and risks in RWA tokenization

Safeguarding digital assets in a tokenized world.

Introduction to Security in RWA Tokenization

Tokenizing real-world assets (RWAs) brings new opportunities, but it also introduces critical security challenges. Ensuring proper custody, risk mitigation, and smart contract security is essential for protecting investor funds and maintaining confidence in these digital assets. From safeguarding private keys to understanding counterparty risks, participants in the RWA tokenization space must adhere to best practices to minimize threats and maintain asset integrity.

Custody of Tokenized RWAs: Who Holds the Private Keys?

The security of tokenized RWAs starts with custody—the way digital assets are stored and managed. There are two primary custody models:

Self-Custody

With self-custody, investors maintain control of their private keys using hardware wallets or multi-signature solutions. While this approach provides full ownership, it requires users to follow strict security protocols to prevent key loss or theft.

Institutional Custody

Third-party custodians like Fireblocks and BitGo manage private keys on behalf of investors, offering additional security layers, insurance coverage, and compliance measures.

It’s interesting to review all of the different models available to individuals and institutions for safeguarding private keys. Choosing the right custody model depends on risk tolerance, technical expertise, and regulatory requirements. But, in all cases, doing thorough research before taking action is highly recommended, and educational!

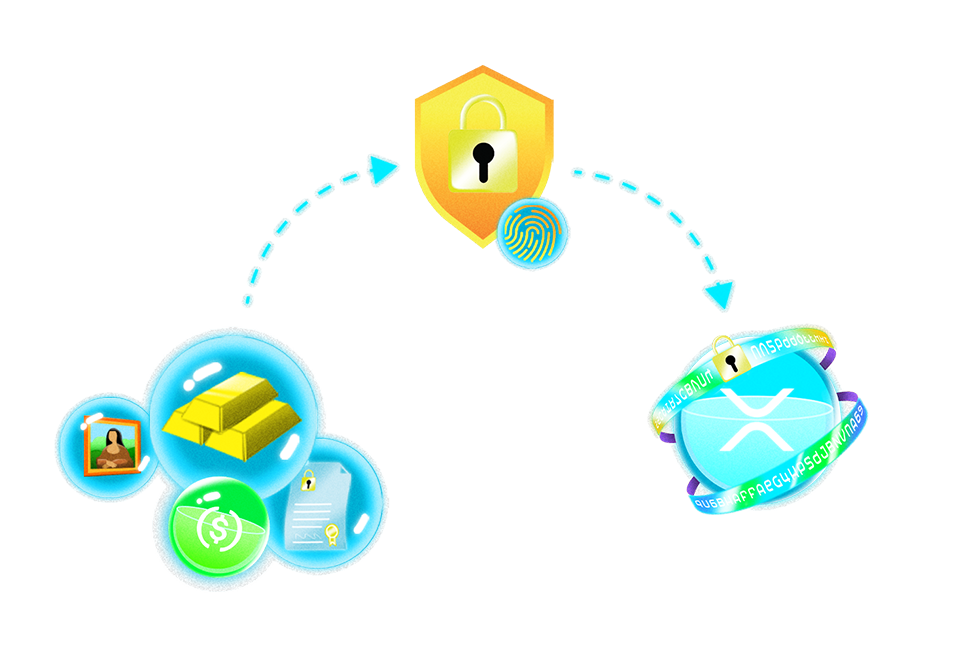

Risk Management: What Happens If a Token is Lost or Stolen?

Loss or theft of tokenized RWAs presents unique challenges. Unlike traditional assets, digital assets rely on cryptographic security, meaning lost private keys may result in permanent asset loss. However, various measures help mitigate these risks:

Legal Provisions

Some tokenized assets include legal frameworks for recovery, where issuers can reissue lost tokens or revoke stolen ones under specific conditions.

Security Reviews

While (thankfully!) high-profile failures in the burgeoning RWA space have been scarce to date, past incidents in large-scale DeFi projects highlight the importance of utilizing secure custody solutions that adhere to best practices.

Insurance Coverage

Some custodians may offer insurance policies to compensate for losses due to hacks or operational failures. It’s crucial for all parties (investors and project owners) to review and understand the insurance provisions of the RWA custodian to ensure adequate protection for their digital assets.

By implementing robust security measures, asset holders can reduce exposure to risks associated with tokenized RWAs.

On-Chain Security in XRPL Tokenization

Security in RWA tokenization extends beyond custody—it also includes on-chain security. The XRP Ledger (XRPL) incorporates several mechanisms to ensure secure token issuance and transactions:

Trustlines & Issued Currencies

XRPL requires trustlines to mitigate counterparty risks, ensuring only authorized users can interact with tokenized assets.

On-Ledger Security Features

XRPL has built-in features like escrow, payment channels, and multi-signing to enhance asset security and transaction reliability.

Risk Minimization Strategies

Using decentralized identity verification, authorized token issuers (XRP native functionality), and secure oracles (trusted data sources) helps reduce fraud risks.

Where advanced programmability is required, projects will soon be able to use Hooks (a proposed XRPL feature for lightweight smart contract-like functionality) and/or the new XRPL EVM Sidechain (currently on XRPL Devnet) for full smart contract capabilities. By leveraging these tools, tokenized assets on XRPL will maintain security, transparency, and reliability.