Lesson 6

Key use cases for RWA tokenization

Unlocking new financial opportunities through tokenized assets.

Introduction to RWA Tokenization

Real-world asset (RWA) tokenization is no longer a concept of the future—it’s actively reshaping financial markets today. By converting physical or traditional financial assets into blockchain-based tokens, tokenization enhances liquidity, accessibility, and efficiency while reducing operational friction.

From treasuries and real estate to debt instruments and DeFi yield strategies, multiple industries are already benefiting from the advantages of tokenization. These innovations help bridge traditional finance (TradFi) with decentralized finance (DeFi), unlocking new opportunities for investors and institutions alike.

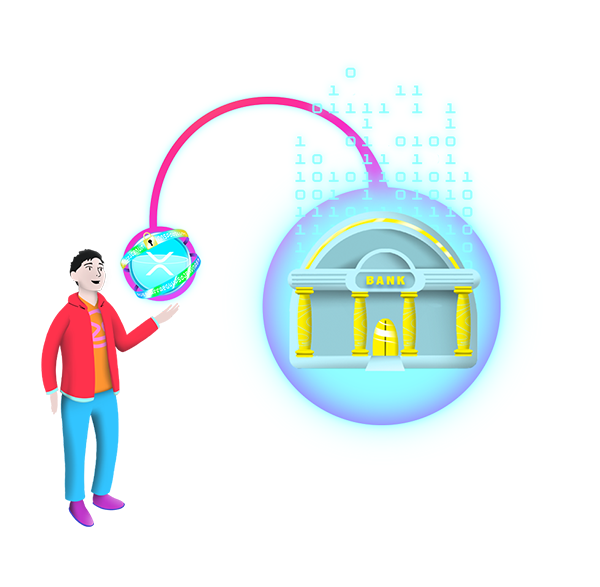

Tokenized Treasuries: A Safer Investment Alternative

Tokenized treasuries are quickly gaining traction as a viable alternative to stablecoins for low-risk investments. These digital assets may provide higher yields compared to traditional stablecoins while maintaining stability and security. A prime example of this application is Archax’s use of the XRP Ledger (XRPL) to tokenize part of abrdn’s £3.8 billion US Dollar Liquidity Fund (Lux). This showcases how blockchain technology can streamline fund management, enhance liquidity, and provide investors with more accessible financial instruments.

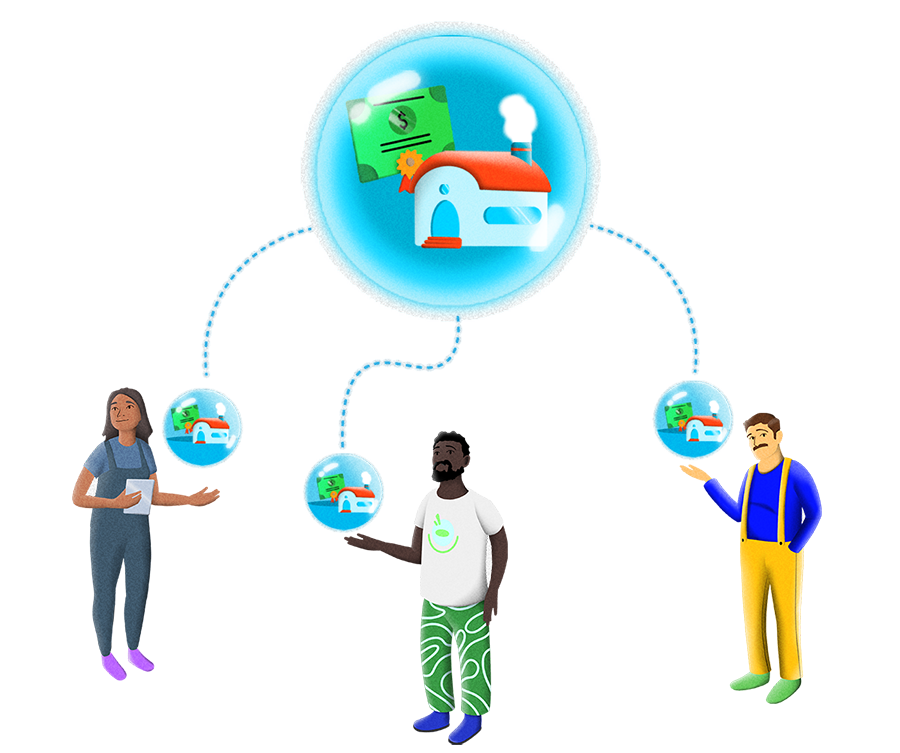

Real Estate: Fractional Ownership and Global Access

Real estate tokenization has emerged as a powerful tool for democratizing property investment. Traditionally, real estate transactions involve high capital requirements and complex paperwork. Tokenization addresses these barriers by enabling fractional ownership, allowing investors to buy and sell shares of properties with ease. Companies like HouseBit and RealT are pioneering this model, making it easier for individuals to diversify their portfolios without the limitations of geographical borders or large capital investments. Tokenization fosters a more inclusive and efficient real estate market.

Tokenized Debt: Streamlining Bonds and Credit Markets

Tokenization is also revolutionizing debt markets. By digitizing bonds and other debt instruments, the process of issuance and trading becomes more efficient and cost-effective. Smart contracts help automate interest payments and settlements, reducing intermediaries and increasing transparency.

Onchain credit markets are expanding the accessibility of tokenized securities, attracting institutional investors looking for streamlined, lower-cost alternatives to traditional bond markets.

Yield Strategies: Connecting TradFi and DeFi

As RWA tokenization grows, its impact on yield strategies within DeFi becomes increasingly evident. Tokenized assets generate stable and predictable returns, making them attractive to both institutional and retail investors. By bridging TradFi and DeFi, these digital assets enhance liquidity in decentralized protocols, allowing investors to access higher-yield opportunities while benefiting from blockchain’s efficiency and security. However, regulated on- and off-ramps remain crucial to ensuring transparency, accountability, and widespread institutional adoption.