Lesson 5

Introduction to tokenization on the XRPL

A High-Performance Blockchain for Global Payments and Tokenization

Looking Ahead: The Future of RWAs

As financial markets evolve, the inefficiencies of traditional RWA management are being addressed through technological advancements. Blockchain technology and tokenization are emerging as potential solutions, offering:

Improved Liquidity

- By enabling fractional ownership and digital trading, assets like real estate and fine art can be more easily bought and sold.

Faster Transactions

- Automated smart contracts can streamline settlement processes, reducing reliance on intermediaries.

Enhanced Transparency

- Decentralized ledgers provide real-time, tamper-proof records, reducing fraud risks.

- Understanding RWAs and their challenges is the first step toward recognizing how digital innovations can transform asset ownership and finance.

A Perfect Match: XRPL + Tokenization

Tokenization is revolutionizing the financial and digital asset ecosystem by enabling real-world and digital assets to exist on blockchain networks. The XRP Ledger (XRPL) has established itself as a powerful platform for tokenization due to its speed, low fees, and efficiency. Let’s dive into tokenization on the XRPL, exploring its benefits, use cases, and how institutions, developers and businesses can leverage this technology.

XRPL’s Built-in Features for Tokenization

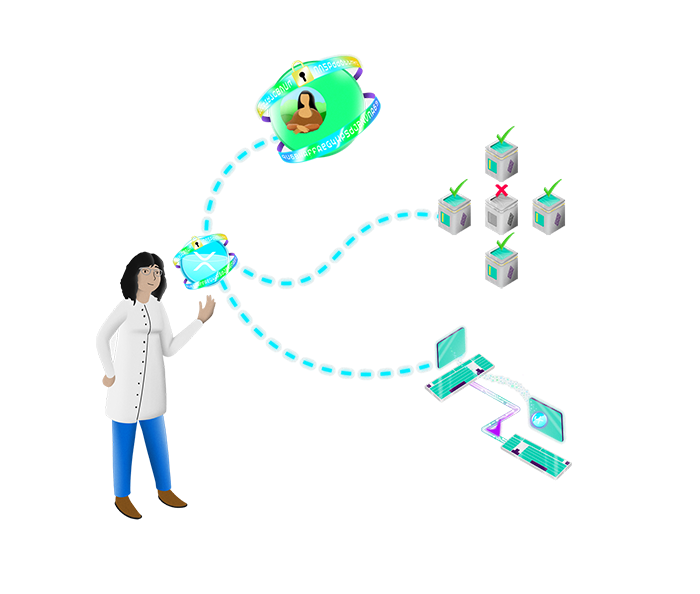

The XRP Ledger’s Token Standard XRPL provides a native tokenization framework that allows users to issue and transfer tokens efficiently. These tokens can represent anything from stablecoins to tokenized real-world assets (RWAs). Unlike many blockchains, XRPL’s structure prevents spam tokens from clogging the network, maintaining a high-quality token ecosystem.

The impact of XRPL’s DEX on Tokenization

- XRPL’s native DEX offers a multitude of beneficial features for streamlining tokenization processes.

High frequency trading

- With innately low-cost transactions that settle in seconds, the XRPL DEX is well positioned for high-frequency token trading.

Interoperability

- The XRPL DEX natively converts currency, enabling seamless trades across tokens and digital markets.

Real World Asset Trading

- XRPL’s DEX enables tokenized, fractional versions of tangible assets to be traded between users quickly and efficiently.

Regulatory Compliance

-

- The DEX offers native compliance options for regulated RWA markets including issuer control and blacklisting functionality.

Trustlines and Accounts

To interact with tokenized assets on XRPL, users must establish Trustlines, which define the maximum amount of a token they are willing to hold. This is the mechanism that prevents spam tokens from being forcibly sent to users, a common problem on other blockchain networks.

Additionally, XRPL accounts are lightweight and efficient, allowing users to participate in the network without excessive fees or resource consumption.

Issued Currencies (IOUs) and Real-World Examples

XRPL’s Issued Currencies (IOUs) system enables institutions and businesses to create digital representations of assets such as fiat currencies, commodities, and securities. Several projects and partnerships are leveraging XRPL for real-world asset (RWA) tokenization, including:

- Ondo Finance’s tokenized U.S. Treasuries on XRPL.

- Ripple’s collaboration with financial institutions for cross-border payments.

- BlocScale’s efforts to accelerate real-world asset tokenization.

As the industry moves toward digital tools, we’re starting to see new ways of recording and exchanging RWAs. In the next lesson, we’ll look at how the process of tokenization turns real world assets into digital tokens to improve liquidity, reduce settlement times, and open up new ways to trade value.