Lesson 2

Exploring challenges with real-world assets (RWA’s) in traditional finance

RWA’s account for a majority of the world’s economy and financial institutions have always struggled to make them simple.

Real World Assets (RWA’s) play a crucial role in traditional finance but without tokenization, they face challenges such as liquidity, slow settlements, and transparency issues.

High Barrier to Entry

RWA’s often require large capital commitments, which means that they aren’t very accessible to retail investors. It also means that even while owning them, financial institutions are less likely to trade them, reducing the depth of the market.

Liquidity Issues

Many RWAs, such as real estate and art, are difficult to convert into cash quickly and often require payment over time options to ease the financial burden on the purchaser. Paying for a large asset over time means it might be tied up in a contract and can’t be leveraged by the future owner until it is paid off. For the same reason, a seller may not have all the asset’s value in cash for years after the sale.

Slow Settlement Process

Transferring ownership or using RWAs as collateral often involves extensive administrative work, with the potential for delays and human-made errors. When buying or selling real estate, the sale usually doesn’t happen instantly. Contracts and paperwork always lead to negotiations and some back and forth which increase the time it takes to close the sale.

Disorganized Records

Paper-based or fragmented digital records make asset verification and tracking inefficient. Financial organizations often struggle with verifying asset ownership due to privatized and siloed databases.

Non-Fractional Ownership

Unlike digital assets, RWA’s that are not tokenized are usually owned in full, making it difficult to divide and trade them in smaller portions without complex contractual structures.

Manual and Labor-Intensive Processes

Asset transfers, collateral verification, and compliance checks require significant human effort, increasing costs and processing times. These challenges highlight the need for modernization in RWA management, paving the way for blockchain and tokenization solutions.

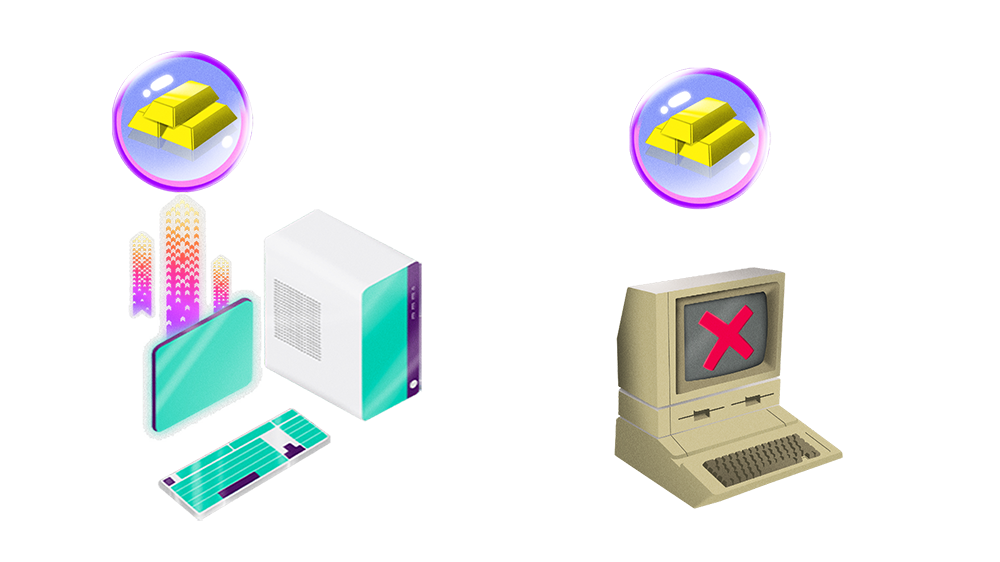

Tracking RWA’s on the Blockchain Reduces Human Error

Common across global and local economies, these inefficiencies have existed since humans began trading goods and services. Historically, tracking ownership and transactions of RWAs has relied on:

- Receipts and invoices for proof of purchase and transactions.

- Ledgers maintained by financial institutions to record asset holdings.

- Deeds and contracts to establish ownership rights, especially in real estate and intellectual property.

While these methods have been effective for centuries, they are often cumbersome, prone to loss or forgery, and difficult to verify quickly. Financial institutions and regulators struggle with disorganized documentation, making it harder to assess asset value and risk accurately.

As the financial world transforms, digital assets and tokenization both aim to streamline how RWA’s are recorded, verified, and exchanged.