Lesson 3

Stablecoins, Transfers, and Liquidity on XRPL

How stablecoins flow and trade across the XRP Ledger.

For stablecoins to succeed, they must do more than exist—they must move. They need to be exchanged, bridged, and traded in real time with low fees and high liquidity. The XRP Ledger (XRPL) was built with these exact needs in mind.

At the heart of this capability are XRPL’s transfer mechanisms: trust lines, pathfinding, and its built-in decentralized exchange (DEX). With the addition of the Automated Market Maker (AMM)—a game-changing feature—XRPL now offers even more efficient liquidity and pricing.

In this lesson, we’ll explore how stablecoins move through the XRPL, how trading pairs and liquidity pools are created, and how XRP itself plays a crucial role as a bridge currency.

Transfer Mechanics on XRPL

Trust lines

Let’s start with the basics: trust lines. These allow a user to hold a specific stablecoin and confirm they “trust” the issuing account. Without a trust line, that token won’t appear in your wallet—this prevents spam and gives users control.

Pathfinding

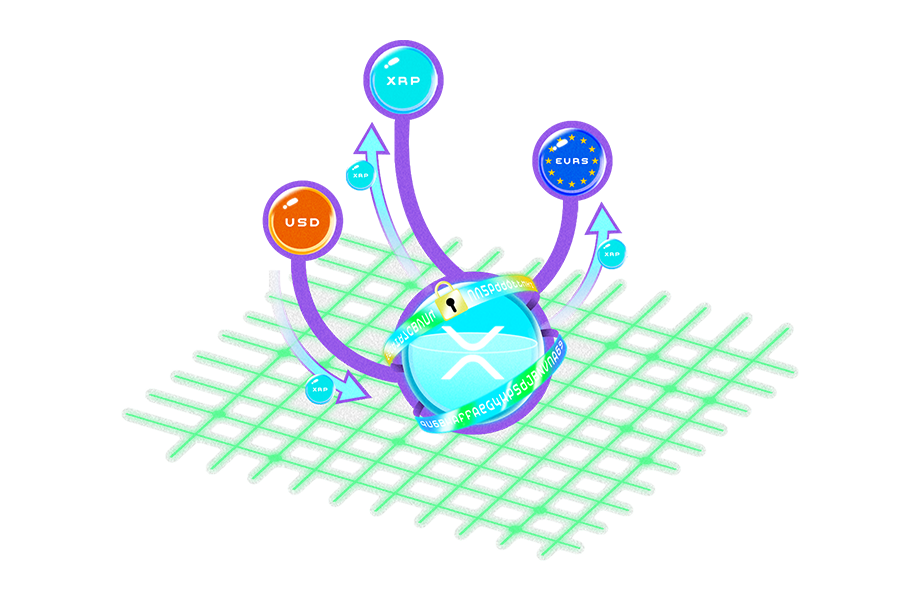

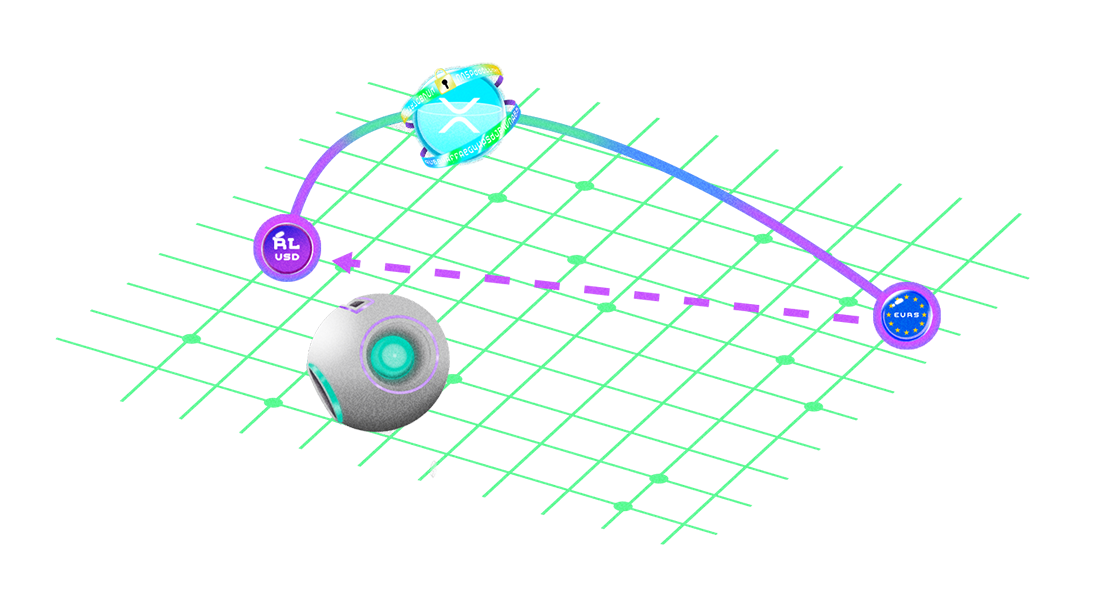

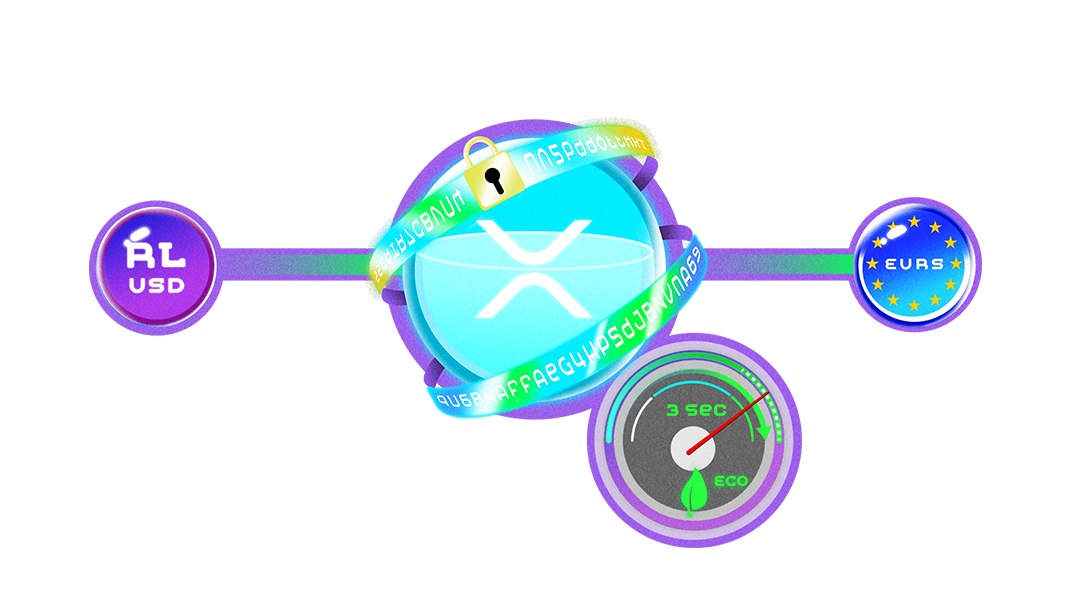

When a user initiates a trade or transfer between assets, pathfinding kicks in. This unique XRPL feature scans the network for the most efficient path between currencies. For example, if you’re trading RLUSD for EURS, XRPL may discover that the cheapest path is through XRP: RLUSD → XRP → EURS.

This is one of the reasons XRP is known as a bridge asset—its deep liquidity and universal pairing make it a natural connector between otherwise unrelated tokens.

The XRPL’s Decentralized Exchange (DEX) is where most of this magic happens. Unlike external platforms, the DEX is built directly into the ledger. Users can place limit orders, view the global order book, and trade between any two assets issued on XRPL.

On the XRP chain, new features are added periodically via XLS proposals. (XLS stands for XRP Ledger Specification. They are released as numbered proposals and voted on periodically, similar to the Improvement Proposals found on other chains like Ethereum and Bitcoin.)

With the launch of XLS-30 in March 2024, XRPL supports Automated Market Makers (AMMs)—a major boost to stablecoin liquidity. AMMs allow users to deposit two tokens (like RLUSD and XRP) into a liquidity pool, which then automatically handles swaps.

For example, if you deposit 1,000 RLUSD and 1,000 XRP into a pool, you become a “liquidity provider.” Every time someone trades RLUSD ↔ XRP using your pool, you earn a percentage of the trading fees (which are 0.3% on the XRP DEX). (You would be paid these fees in liquidity provider tokens, known as LP tokens, which you could redeem for pool assets. You can also do some other cool things with LP tokens. XLRP has a nice article on this, here.)

Best of all, the AMM integrates with the DEX’s order book, creating a unified trading environment that balances precision with automation.

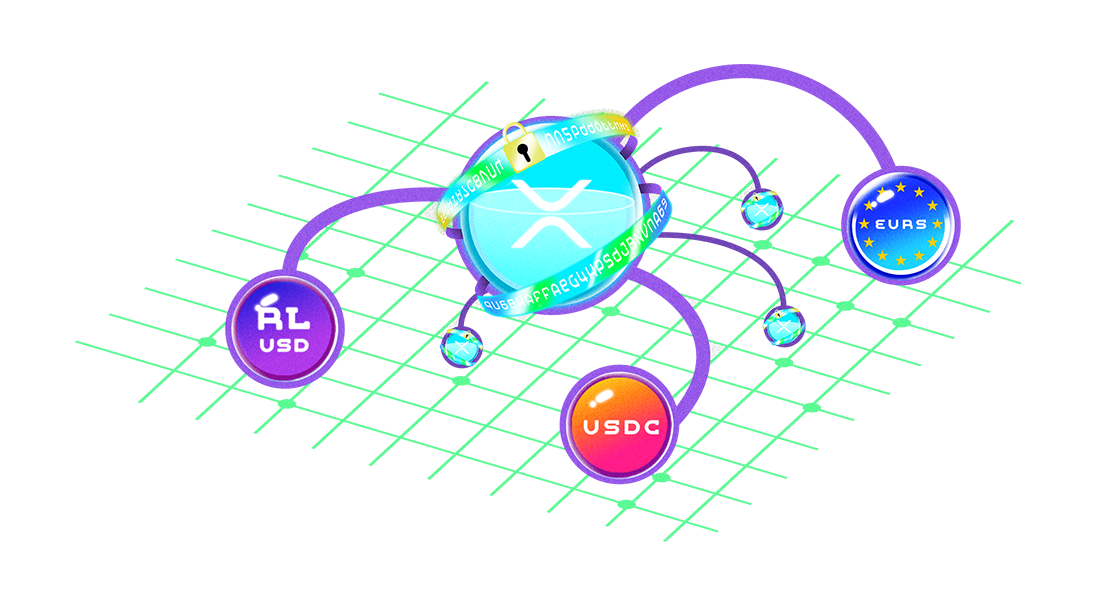

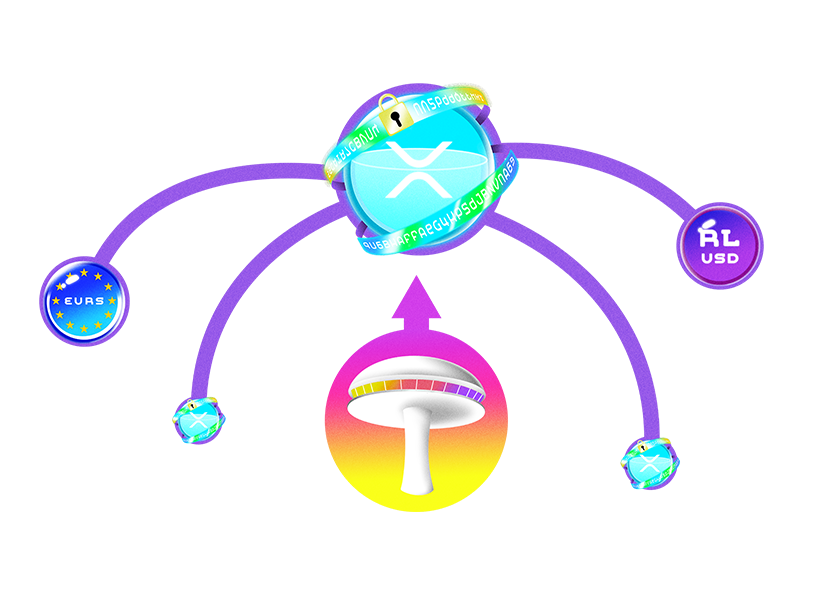

Interoperability is the next frontier. XRPL’s architecture is designed to work with wrapped tokens and cross-chain bridges. Imagine a stablecoin like USDC being wrapped and issued natively on XRPL—suddenly, it’s tradable on the XRPL DEX just like RLUSD.

Bridging technology is improving fast. The XRPL EVM sidechain uses Axelar (a cross-chain communication network that allows smart contracts and dApps to talk to each other across different blockchains) to connect XRPL with over 50 other blockchains. This means liquidity can flow seamlessly across Ethereum, Avalanche, Cosmos, and back—ideal for DeFi arbitrage, cross-border remittances, and stablecoin exchanges.

By supporting wrapped assets and bridging, XRPL brings global liquidity to a high-speed, eco-friendly, and secure layer-1 platform.

XRP as the Universal Bridge Asset

XRP’s role on the DEX can’t be overstated. Because XRP is deeply integrated into the XRPL ecosystem—and doesn’t require trust lines—it can act as the fastest path between stablecoins and other assets.

When liquidity is low between two stablecoins, XRPL can automatically route trades through XRP, improving speed, lowering costs, and expanding access.

For example, suppose there’s limited direct liquidity between RLUSD and EURS. The DEX will route the trade like this: RLUSD → XRP → EURS, using two highly liquid pairs instead of one illiquid pair. It’s all automatic, and users barely notice.

This is part of what makes XRPL’s ecosystem so efficient. By leveraging XRP as a bridge, it ensures stablecoins can always move, even if direct markets are thin.

As stablecoin issuance and adoption accelerate, they drive increased activity on the XRP Ledger—every transaction requires XRP for fees. This results in XRP being burned, gradually reducing supply. That built-in scarcity mechanism boosts long-term demand for XRP itself, making stablecoins a powerful catalyst for the entire XRP ecosystem.

A New Era of Liquidity on XRPL

The combination of pathfinding, built-in DEX functionality, and AMMs makes the XRP Ledger one of the most versatile and efficient networks for managing stablecoin liquidity.

With new bridges emerging, wrapped assets appearing, and the EVM sidechain on the horizon, XRPL is positioning itself as a central hub in a multi-chain world.

And XRP itself isn’t just a native token—it’s a liquidity engine, ensuring every asset can trade freely, instantly, and affordably.

For stablecoin issuers, traders, and builders, understanding these mechanisms is the key to unlocking XRPL’s full potential.

Looking ahead, the XRPL EVM Sidechain—now in testnet—will bring Ethereum-compatible smart contracts to the XRP Ledger. With planned integration via Axelar, it could enable seamless asset transfers across 50+ blockchains, dramatically expanding stablecoin utility and interoperability.

For those interested in learning more about the EVM Sidechain, here are some handy bookmarks: