Lesson 1

Introduction to Stablecoins on the XRP Ledger

Faster, greener, and ready for global finance.

Stablecoins are a type of digital asset designed to maintain a stable value—typically pegged to a currency like the U.S. dollar or euro. They play a critical role in making cryptocurrencies more usable for payments, trading, and saving.

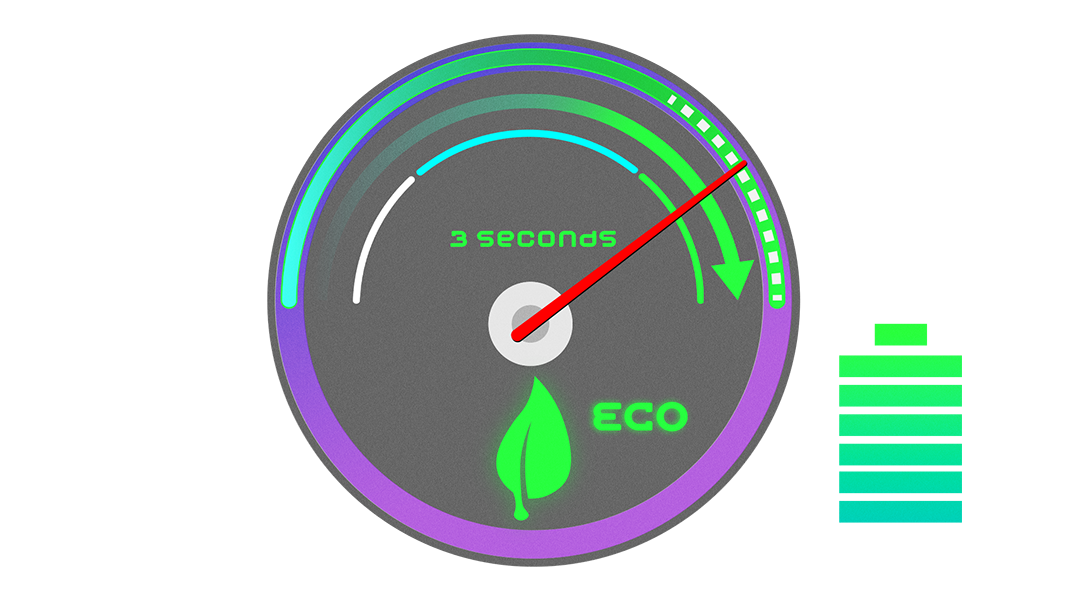

The XRP Ledger (XRPL) has quickly become one of the more attractive platforms for issuing and using stablecoins. Why? Because it combines extremely fast settlement times (3-5 seconds), ultra-low transaction fees, and an environmentally friendly design—all while avoiding the congestion and energy demands of many other blockchains.

This lesson explores why XRPL is uniquely positioned to support stablecoin innovation, and how it already hosts several major stablecoins, with more on the way.

Why Issue Stablecoins on the XRP Ledger?

Fast Transactions

Speed is everything in finance. On XRPL, transactions settle in about 3 – 5 seconds. Compare that to Ethereum’s average 15- to 60-second confirmation time or even Solana’s faster but sometimes unstable performance. This consistency is essential for any financial instrument, especially one meant to mimic the stability of fiat money.

Low Fees

XRPL’s fees are a fraction of a cent—often less than $0.001—making it ideal for microtransactions, cross-border payments, and DeFi applications. Unlike Ethereum, which uses a gas fee model that can become expensive and unpredictable, XRPL fees remain low and reliable.

Low Energy Consumption

Another standout feature is the environmental impact. The XRPL uses a consensus mechanism instead of mining, resulting in extremely low energy consumption—perfect for institutions and developers with sustainability goals.

Mature Developer Ecosystem

Beyond the tech itself, the XRPL offers a mature developer ecosystem with strong documentation, vibrant community forums, and funding opportunities through programs like RippleX and the XRPL Grants initiative.

Native Decentralized Exchange (DEX)

Stablecoin issuers can also benefit from XRPL’s native decentralized exchange (DEX), allowing seamless trading of stablecoins against XRP or other assets issued on the network. This built-in liquidity pool reduces the need for external bridges or protocols.

Native Smart Contract Capabilities

Stablecoins on XRPL fall under the “Issued Currencies” model. Instead of deploying a smart contract (as on Ethereum), issuers use XRPL’s native functionality to create and manage tokens. These tokens—often fiat-backed—can be sent, received, and traded with full visibility and speed.

Trust Lines

Trust lines are a unique part of this system. Before users can hold a particular stablecoin, they must open a trust line to that issuer. This permission system ensures that only trusted assets appear in a user’s wallet and gives users full control over which assets they interact with.

Wide Variety of Use Cases

Within this model, stablecoins can be fiat-backed (like EURS or RLUSD), crypto-backed, commodity-backed, or even represent financial instruments. The XRPL’s flexibility supports a wide variety of use cases—from cross-border payments to tokenized securities. Here’s a quick overview:

| Type | Description | Example on XRPL |

| Fiat Backed | Backed 1:1 by fiat currency, e.g., USD, EUR, YEN, etc. | RLUSD, EURS |

| Crypto Backed | Backed by cryptocurrency, more volatile | Less common on XRPL |

| Commodity-backed | Backed by assets like gold, less common on XRPL | Potential future use |

| Financial Instrument Backed | Backed by bonds or equity shares | |

| Non-collateralized | No collateral required. Value controlled by supply/demand. |

EURS and RLUSD: Stablecoins on XRPL

EURS

One of the first major stablecoins on the XRPL is EURS, issued by STASIS. Pegged to the euro, EURS is used for cross-border payments and DeFi applications. Its integration on the XRPL makes it easily tradable and highly accessible.

RLUSD

Ripple’s own stablecoin, RLUSD, has also made waves in the ecosystem since its launch in 2024, issued by Standard Custody & Trust Company, a regulated entity. With a $1 billion+ market cap as of November 2025, RLUSD is positioned to become a key piece of Ripple’s broader payment solutions and liquidity strategy.

Both of these assets, along with other much smaller current XRPL stables like VHCF and AUDD, demonstrate the growing confidence in XRPL as a stablecoin platform—and hint at a future filled with digital assets tied to real-world value.

Stablecoins, Evolved

The evolution of stablecoins is more than just a technical upgrade—it’s about unlocking financial access, speed, and stability for users worldwide. The XRPL’s low cost, speed, and eco-friendly design make it a natural fit for this transformation.

As more stablecoins launch on XRPL, expect innovation not just in currencies, but in how finance itself works: programmable, decentralized, and user-controlled.

From EURS to RLUSD, the ecosystem is expanding—offering new ways to interact with money, move assets across borders, and build DeFi applications with real-world value.