Lesson 2

How to Issue a Stablecoin on the XRP Ledger

From creation to compliance: launching a trusted digital asset.

The XRP Ledger makes it simple and efficient to launch your own stablecoin. From setting up your issuing account to ensuring regulatory compliance, stablecoin issuers have a variety of responsibilities to ensure user trust and long-term viability.

Whether your stablecoin is pegged to a fiat currency, a commodity, or another asset, the XRPL provides the infrastructure. But it’s the issuer’s job to build the bridge—connecting value from the traditional financial world to a stable digital token.

In this lesson, we’ll walk through the process of issuing a stablecoin on the XRPL, highlight best practices, and point out potential risks every issuer should keep in mind.

Steps to Launch a Stablecoin on XRPL

1. Set Up an Issuing Account

Your stablecoin begins with an “issuing account” on the XRP Ledger. This is the account that creates and distributes the stablecoin tokens. It’s also the foundation for your brand, reputation, and technical setup.

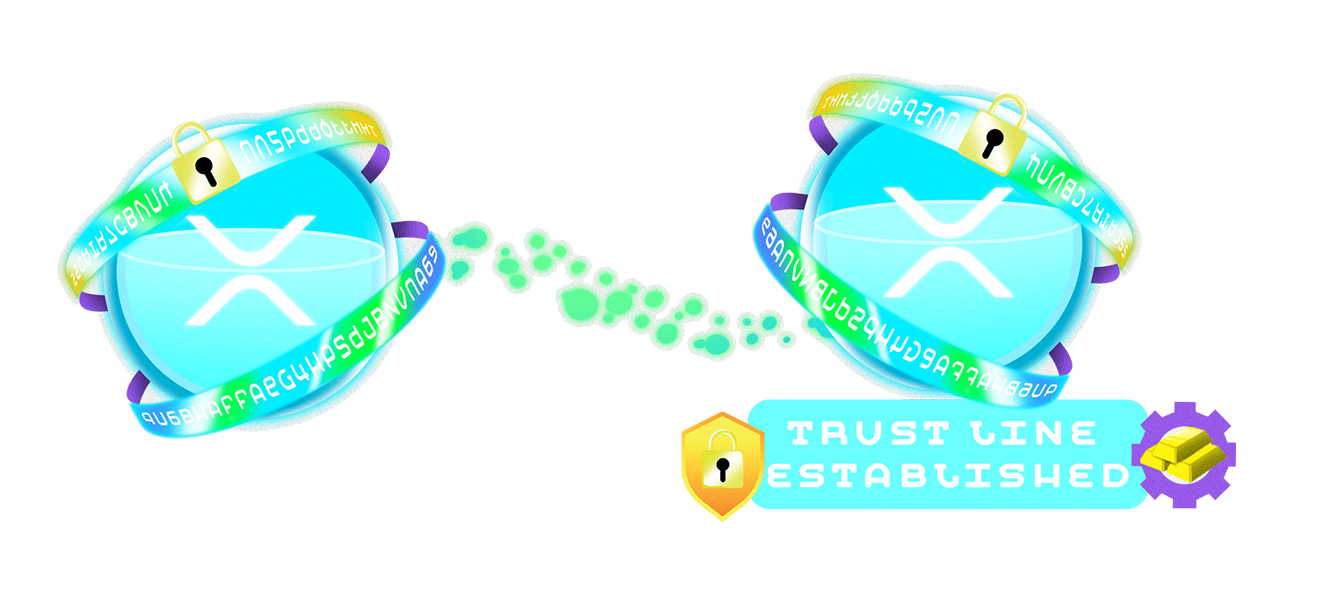

2. Establish Trust Lines

Before others can hold your stablecoin, they need to establish a trust line to your issuing account. This is a safeguard that lets users choose which assets they want in their wallets. It’s a key difference from most other chains.

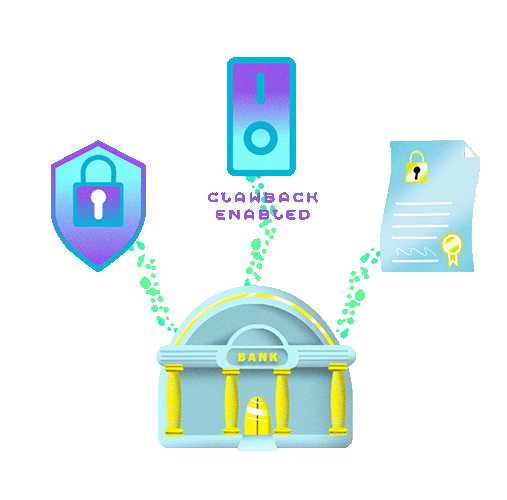

3. Define Transaction Settings

You’ll need to set your reserve requirements (how much XRP must be held by your account), define any transfer fees, and decide on advanced settings such as enabling “clawbacks” (more on that soon).

These steps allow you to create a token—but to build trust and functionality, there’s more to consider.

Best Practices Matter.

Simply issuing a stablecoin isn’t enough. To ensure adoption and stability, your project should follow industry best practices:

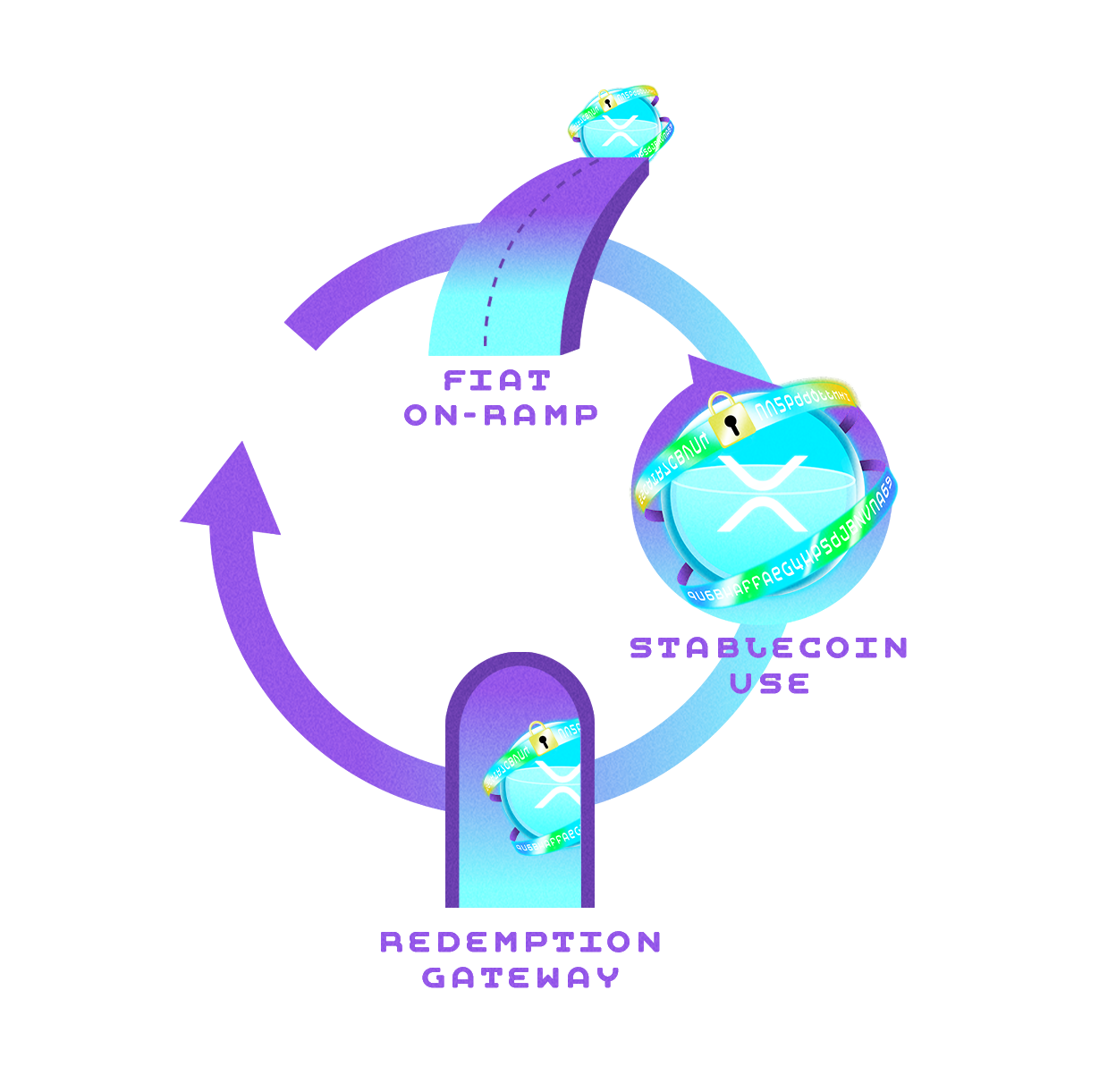

On-Ramps

Make it easy for users to acquire your stablecoin—whether by converting fiat or swapping other crypto assets. The more accessible your token is, the more useful it becomes.

Liquidity

Make sure your token can be bought, sold, and traded with ease. Using XRPL’s native DEX or partnering with market makers helps ensure price stability and usability.

Compliance

Be aware of your jurisdiction’s requirements for anti-money laundering (AML) and know-your-customer (KYC) regulations. Features like clawbacks—unique to XRPL—can help you stay compliant by allowing you to recover assets from bad actors, but they must be explicitly enabled at setup.

Transparency Builds Trust.

Trust is everything when it comes to stablecoins. Since users can’t always verify how well a stablecoin is backed, it is crucial to show the process and proof that the stablecoin is fully backed by a tangible asset or a fiat currency.

For example, Ripple’s recently issued RLUSD stablecoin is supported by monthly attestation reports, giving users confidence that every token is fully backed. Following this model, your project should consider third-party audits and real-time reserve tracking if possible.

Redemption Gateways are another essential piece of the puzzle. Users must be able to not only buy your stablecoin, but also redeem it for fiat—completing the financial cycle. Without clear exit ramps, trust and utility diminish.

Compliance and Risk Awareness

Issuing a stablecoin means stepping into a regulated financial environment. Here are a few important considerations:

KYC/AML

Depending on your jurisdiction, you may need to verify user identities or report suspicious activity.

Clawbacks

If your use case requires additional security, XRPL’s clawback feature lets you revoke or reissue tokens under certain conditions—especially useful for combating fraud or complying with legal demands.

Issuer Risk

Users rely on you to redeem their tokens 1:1. If your reserves are mishandled or your company becomes insolvent, users could lose value—just like in a traditional bank failure.

To protect both users and your project, transparency and legal preparedness should be top priorities.

The Full Stablecoin Lifecycle

A stablecoin isn’t just a technical token—it’s a financial product with a lifecycle. Users need an entry point (on-ramp), utility in the ecosystem, and a reliable way to exit (redemption). The XRPL provides the technical foundation, but the issuer must create the real-world infrastructure described herein.

This means building partnerships with fiat providers, ensuring ongoing liquidity, and maintaining regular public updates about the state of your reserves. A clean, professional, and regularly updated website to house all of these policies and updates is definitely a solid idea here.

Stablecoins can offer a powerful bridge between traditional finance and blockchain, but they also require responsibility. With careful planning, regulatory awareness, and a commitment to transparency, your stablecoin can thrive on XRPL—just like RLUSD is poised to do.