Lesson 4

Emerging DeFi Use Cases for Stablecoins on XRPL

Exploring yield opportunities and risks in XRPL’s evolving DeFi ecosystem.

Stablecoins are not just a medium of exchange—they’re becoming a foundational asset in decentralized finance (DeFi). On the XRP Ledger, this transformation is beginning to take shape through features like Automated Market Makers (AMMs) and the upcoming Hooks (currently live in testnet stage) smart contract framework.

While XRPL’s DeFi infrastructure is still emerging, there are already ways for users to earn passive income using stablecoins. Whether it’s earning AMM fees by providing liquidity or, in the future, staking or lending tokens for rewards, stablecoins are set to play a major role.

This lesson explores these potential DeFi applications on XRPL, with a focus on current opportunities, future developments, and important risks to understand before diving in.

Stablecoin Liquidity and Passive Income

The most active DeFi use case for stablecoins on XRPL right now is providing liquidity to AMM pools. For example, depositing RLUSD and XRP into an AMM pool earns you a portion of the trading fees—currently a real way to generate yield.

This is similar to staking in that funds are locked for a period, and returns are tied to network activity. (By the way, “staking” is basically when you lock up assets to secure a network, whereas “providing liquidity” is for facilitating trading/swapping, as described here. They’re somewhat similar, but distinct.) As more users trade between RLUSD and XRP, more fees accumulate in the pool, shared by all liquidity providers.

Lending and staking stablecoins are promising future applications. Though not yet live on XRPL Mainnet, the ecosystem is preparing to support them as functionality matures—especially with the Hooks system on the horizon. (Hooks add smart contract functionality to XRPL, a complex topic covered in the XRPL Hooks documentation, here.)

Lending with stablecoins is a core part of DeFi elsewhere—and XRPL is moving in that direction. Two models are likely to emerge:

Peer-to-Peer Lending

Users directly lend their stablecoins to others in exchange for interest. Terms may be negotiated individually or facilitated via platforms.

Smart Contract-Based Lending

In the future, automated lending platforms may be built using Hooks, allowing users to deposit stablecoins into a shared pool. Borrowers lock collateral and borrow against it. Lenders earn passive interest, and collateral is liquidated if conditions aren’t met.

For now, Hooks is live only on testnet, and its rollout to Mainnet is being evaluated through the XRPL proposal system. But the groundwork is being laid.

Staking stablecoins is another emerging concept. While not yet live, it’s envisioned as a way for users to lock stablecoins into a protocol in exchange for rewards, governance rights, or future token distributions.

A typical staking process would look like this:

- Users lock stablecoins (e.g., RLUSD) into a smart contract.

- Rewards are distributed periodically based on amount and time staked.

- After the staking period, users can withdraw their principal plus rewards.

In XRPL’s current model, AMM participation already mimics some of this: You lock capital into a pool, and in return, you earn trading fees—passive income driven by market activity.

Understanding the Risks of DeFi on XRPL

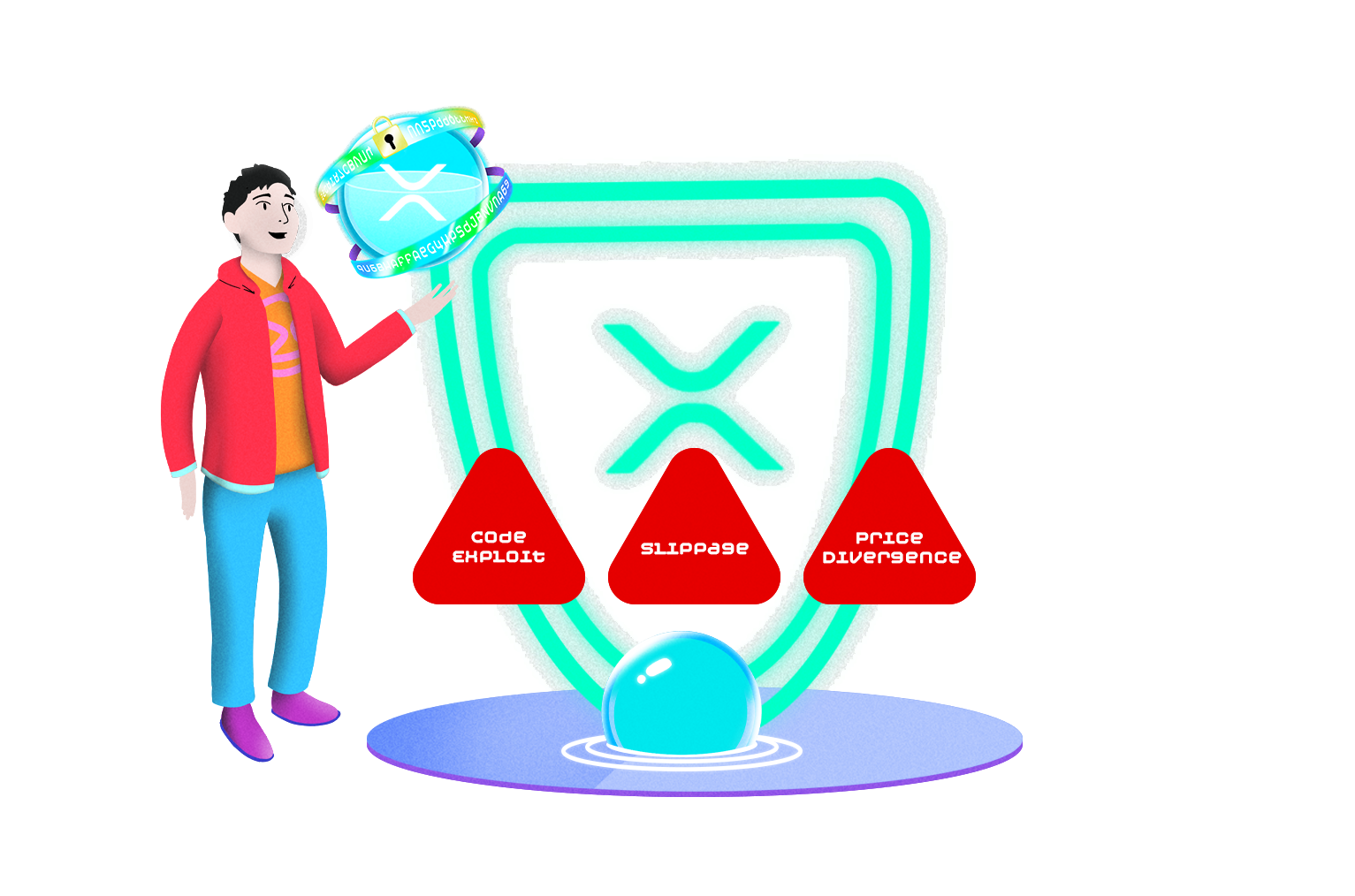

DeFi yields come with real risks on any chain, and XRPL is no exception.

Impermanent Loss

When providing liquidity to an AMM, you may earn fees—but lose value if one asset changes in price significantly. For example, if RLUSD and XRP diverge in price, you might have been better off holding them separately. XRPL’s AMM attempts to reduce this with a continuous auction model, but it can’t eliminate the risk.

Smart Contract Vulnerabilities

XRPL’s AMM has been audited and built with security in mind. However, once Hooks-based lending or staking platforms are live, each new contract could introduce potential bugs or exploits. Always look for audit reports and community reviews.

Liquidity Risk

If a pool has too little liquidity, users may face slippage, meaning trades execute at worse prices. More liquidity = smoother trades and safer yields.

What’s Next for XRPL DeFi?

The XRP Ledger is laying the foundation for an expanded DeFi future. As Hooks moves closer to Mainnet and new tools are developed, stablecoins will play an increasingly central role.

Whether you’re earning fees from an AMM, preparing to lend assets via smart contracts, or planning to stake in a future protocol, understanding the mechanics and risks of each model is essential.

Today, RLUSD and other stablecoins already offer opportunities through AMMs. Tomorrow, they may unlock entirely new layers of DeFi on XRPL—bringing yield, utility, and innovation to users everywhere.

As always, XRP is particularly well-positioned to offer among the best advantages to users in the world of DeFi–lower fees, faster transactions than Ethereum, and of course eco-friendliness.