Lesson 5

Advanced Stablecoin Use Cases and Future Trends on XRPL

Where XRPL stablecoins are headed—from global payments to programmable finance.

Stablecoins on the XRP Ledger are more than just a digital mirror of fiat—they are evolving into practical tools for real-world finance. From cross-border payments to emerging institutional use cases, stablecoins are becoming essential to how money moves in a digital-first world.

XRPL’s fast, low-cost, and eco-friendly design makes it ideal for scalable stablecoin deployments. And as the ledger expands its capabilities with tools like Extensions and Credentials, it’s preparing to meet the demands of institutional users and regulated finance.

In this lesson, we’ll explore how XRPL stablecoins are being used today, and where the technology and regulations are taking them next.

Real-World Impact: Stablecoins in Action

Stablecoins on XRPL are already making waves. One standout example is the Republic of Palau, which launched a national stablecoin pilot on the XRPL. This carbon-neutral digital currency supports local payments and reflects the country’s sustainability goals—perfectly aligned with XRPL’s low-energy design.

Beyond sovereign pilots, XRPL stablecoins are used in remittances, DeFi protocols, and cross-border settlements. A user in the U.S. can send RLUSD to a family member abroad who instantly swaps it into EURS, all in seconds and for a fraction of a cent—thanks to XRPL’s native DEX and fast finality.

As institutional interest grows, stablecoins offer a gateway into DeFi for regulated entities—giving them access to 24/7 liquidity without the volatility of traditional crypto.

The XRP Ledger continues to evolve, and stablecoin use cases will evolve with it.

A major shift on the horizon is regulatory clarity. In the EU, the Markets in Crypto-Assets (MiCA) framework requires stablecoin issuers to hold sufficient reserves and comply with strict anti-money laundering (AML) and transparency requirements.

These changes and others influence how stablecoins need to be issued and managed. Issuers on XRPL—like those behind RLUSD or EURS—need to demonstrate reserve backing and compliance procedures to maintain trust and legality.

Fortunately, XRPL is developing features that align with these new standards, helping ensure the network stays ahead of global regulation.

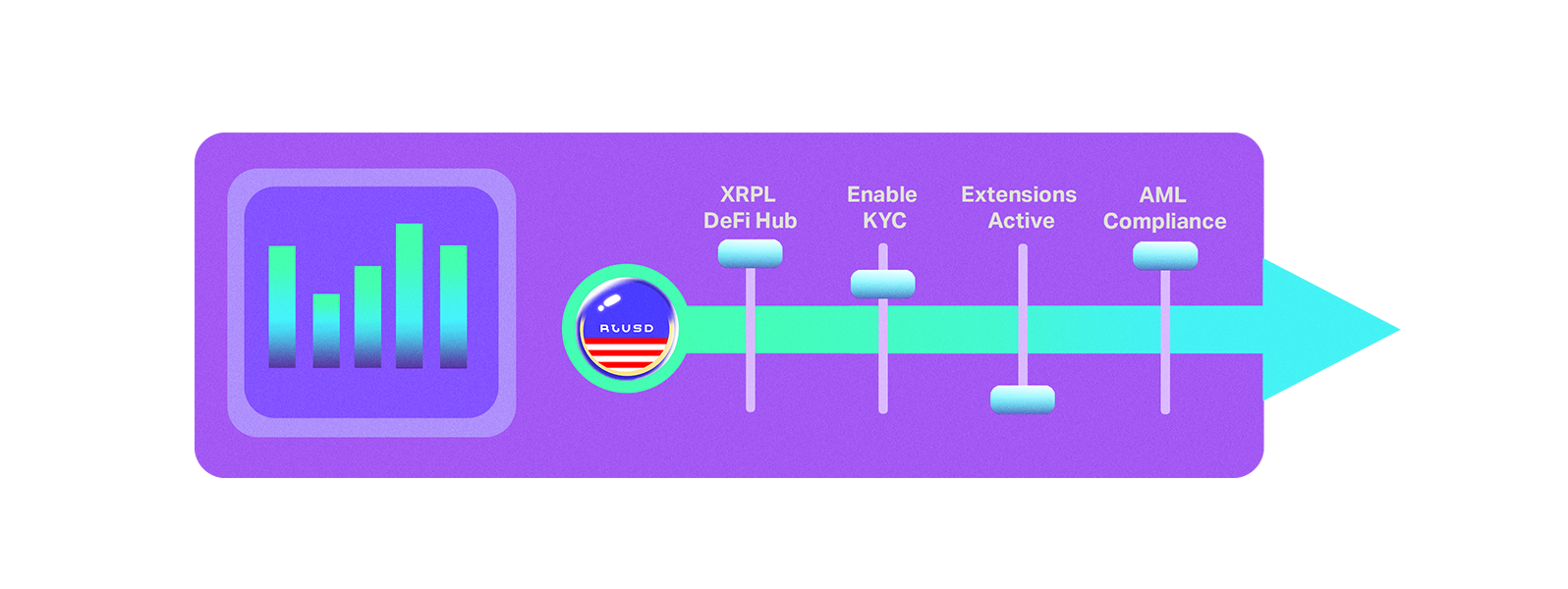

To support these new demands, XRPL is exploring new capabilities—without losing its lightweight, efficient design. Two standout innovations are Extensions and Credentials.

Extensions

Extensions are lightweight bits of code that attach to transactions. While not full smart contracts, they could enable things like automated compliance checks, making sure that a stablecoin transfer meets regulatory or institutional criteria.

Credentials

Credentials are proposed features that allow verified identity data—like KYC status or institutional approval—to be attached to XRPL addresses. This could unlock institutional DeFi, where only pre-approved users can interact with certain tokens or platforms.

These tools, combined with XRPL’s native DEX and AMMs, are transforming the Ledger into a programmable, compliant environment for financial innovation.

Additionally, the XRPL EVM Sidechain enables Ethereum-compatible smart contracts, further expanding stablecoin use cases in DeFi.

Institutional DeFi and the Road Ahead

What does the future hold?

Imagine banks issuing stablecoins on XRPL that automatically verify every transaction using Extensions. Or DeFi platforms offering liquidity pools where only KYC-verified wallets—via Credentials—can stake or borrow. These aren’t sci-fi dreams; they’re next steps being actively discussed and developed on XRPL.

By combining fast, green, low-cost infrastructure with growing programmability and compliance features, XRPL is becoming an increasingly attractive base layer for institutional DeFi.

From remittances in Palau to regulated trading in Europe, XRPL stablecoins are ready to serve users everywhere—and the best is yet to come.

From Use Case to Infrastructure

Stablecoins are evolving from a use case into core financial infrastructure. On the XRP Ledger, they are already powering local payments, remittances, and DeFi—while quietly laying the groundwork for more complex applications.

XRPL’s path forward includes key upgrades: Extension hooks, identity-aware transactions, and support for global regulatory frameworks. These will define how institutions and individuals alike engage with stablecoins in a digital-first economy.

For builders, understanding these trends means preparing for a future where stablecoins aren’t just a product—they’re a platform. One that connects users, countries, and institutions in real-time, and with full transparency.