Lesson 2

XRP-Specific Payment Use Cases

Leveraging XRP for fast, low-cost, and scalable payments.

XRP is designed to solve real-world financial challenges by enabling ultra-fast, low-cost transactions. Unlike traditional payment systems that rely on intermediaries and slow settlement times, XRP provides near-instant liquidity and cross-border payment solutions.

The XRP Ledger (XRPL) enhances financial efficiency for banks, businesses, and individuals by offering decentralized, scalable, and eco-friendly transactions. From international remittances to micropayments and decentralized finance (DeFi), XRP’s use cases continue to expand.

Cross-Border Payments: XRP’s Core Strength

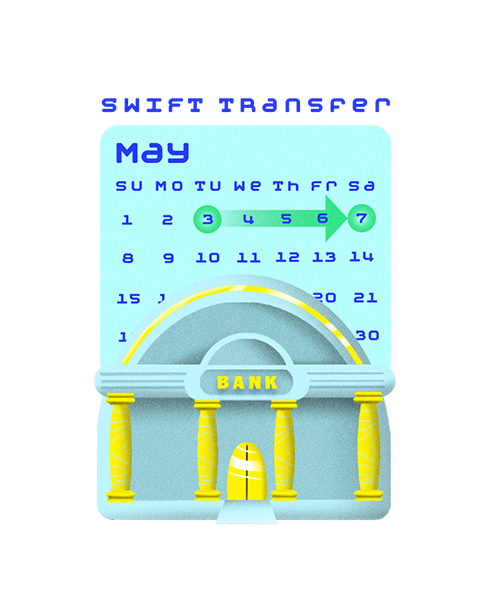

One of XRP’s primary strengths is cross-border payments. In fact, XRP was created with a clear purpose in mind – to solve inefficiencies of notoriously slow international money transfers. Traditional systems like SWIFT can take 1 to 5 days(!) and involve fees from intermediaries. XRP eliminates these inefficiencies:

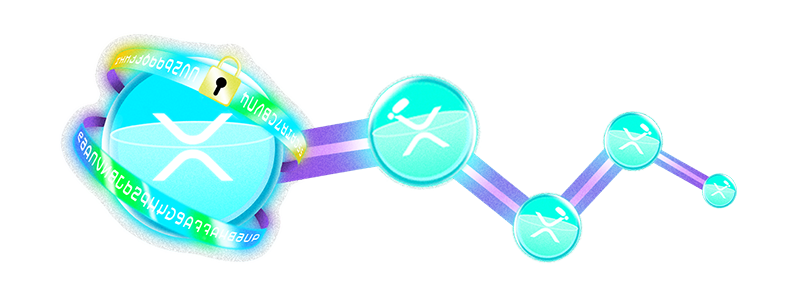

Cross-border payments also benefit from On-Demand Liquidity (ODL), which uses digital assets such as XRP as a bridge token. When used as a bridge token, the sending institution converts local fiat to XRP, sends it abroad, and then the XRP gets converted back to the destination’s local fiat.

Business-to-Business (B2B) Payments

XRP enhances efficiency for global business transactions:

Instant settlement

Companies eliminate float time and accelerate cash flow.

Trade finance

Businesses leverage XRP for quick cross-border trade payments.

Vendor payments

Realtime settlements optimize operations and strengthen supply chains.

Goods and Services

Merchants and businesses increasingly accept XRP for transactions:

E-commerce

Platforms like Shopify and WooCommerce integrate XRPL payment plugins, and adoption is growing.

In-store purchases

Point-of-sale (POS) systems support XRP for rapid transactions.

Gaming

Players make instant in-app purchases using XRP.

Micropayments and Streaming

XRP’s low fees make it ideal for micropayments and digital monetization:

Web monetization

Platforms like XRPTurbo are pushing boundaries, blending AI and XRP to let content creators earn in real-time as users engage—building on early innovations like Coil that once paved the way.

Pay-per-use

Users enjoy seamless, real-time payments for digital services like cloud computing or premium content, powered by XRP’s efficiency.

IoT transactions

Smart devices—think electric cars—autonomously handle XRP payments for services like charging stations, unlocking a connected future.

DeFi and Tokenized Assets

The XRP Ledger supports decentralized finance (DeFi) applications and tokenized assets:

XRPL DEX

A built-in decentralized exchange allows instant, low-cost trading.

Stablecoin payments

Businesses and users transact with stablecoins issued on the XRPL for price stability.

Tokenized Asset Payments

The XRPL supports issued tokens, including stablecoins and tokenized real-world assets (RWAs) like real estate or bonds. XRP serves as an efficient bridge, enabling rapid, low-cost payments or trades via the DEX.

Charitable and P2P Giving

XRP enhances charitable donations and peer-to-peer transactions:

Disaster relief

Organizations could send aid instantly to affected regions.

Social tipping

Social media and content platforms (like Twitter / X or any such platform) could potentially integrate XRP for micro-donations and tips.

Compliance-Friendly Payments

Regulatory clarity and compliance readiness make XRP attractive for financial institutions:

Regulatory clarity

The regulatory landscape makes the XRPL a good option for business adoption. Unlike many other cryptocurrencies, XRP is not a security under U.S. law.

KYC / AML integration

The XRPL has features that fit within existing compliance frameworks, making them suitable for institutional use.

Why it works: XRP was designed from the start to give banks and businesses a fast, reliable payment tool they can trust!