Lesson 13

Understanding Order Books on the XRPL

An efficient order book paves the way for a functional decentralized exchange (DEX)

Order Book Basics: What is a central limit order book (CLOB)?

In the last lesson about XRPL’s decentralized exchange (DEX), we talked a bit about how the XRP ledger uses a central limit order book (CLOB) to trade digital assets. This central limit order book not only ensures efficient trading but also forms the backbone of decentralized exchanges (DEX). The order book is essentially a list of offers from traders to buy or sell tokens for a specific exchange rate. These orders are then sorted, and if there’s another trader who would be happy to take that deal, the orders will “cross” and the assets will be exchanged. These offers can include XRP, or any of the other issued tokenized assets (tokens representing various real-world assets).

The real value of an order book comes when there’s a large volume of traders. Then it becomes very easy to go from assets you have to assets you want for a fair exchange rate. This is often referred to as having “high liquidity” because assets can easily be traded. Exchanges, like central limit order books or automated market makers, form the bedrock of DeFi as a large portion of finance relies on easily being able to trade assets.

XRPL’s Unique Trading Dynamics: The built-in order book

A first-class feature with over a decade of optimizations

The XRPL was originally built to enable the internet of value – a way to move value as easily as data moves on the internet today. As part of that, XRP was intended to be a “bridge currency” to connect all sorts of real world assets using the built-in central limit order book DEX. Just as you can translate between most languages using English as an intermediary, you can trade between any two assets on the XRPL DEX as long as they each have an exchange rate to XRP.

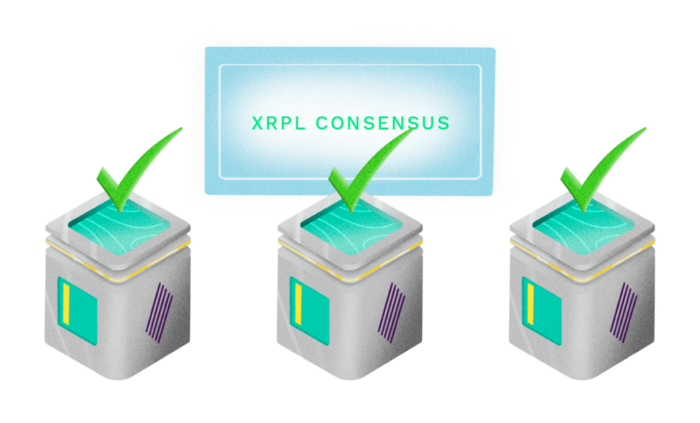

In order to make that work, the DEX had to be very efficient. Since the built-in order book has been a first class feature since Day 1, there’s been over a decade of optimization to enable the XRPL’s DEX to handle the transaction volume we see today. This unique approach of using a built-in order book from the inception distinguishes the XRP Ledger from other blockchains, providing a solid foundation for its role as a bridge currency. The XRPL is one of the few blockchains to use a central limit order book rather than an automated market maker (and is actually in the process of proposing to use both!). Other blockchains often implement their DEX’s via smart contracts which can make it harder to manage the state and computations involved in operating a central limit order book.

Beyond the Order Book, why is the XRPL good for DeFi?

The XRPL‘s Competitive Edge: Low fees and lightning-fast transactions

The XRPL’s blazing-fast transaction settlement and minimal fees are a result of its innovative consensus algorithm, setting it apart in the decentralized finance (DeFi) landscape. Because validators don’t receive rewards from transaction fees, the fees are incredibly low – usually less than a hundredth of a penny. Additionally, since the network does not have to use computation effort to prove trust like in proof-of-work, transactions can settle very quickly (usually in less than 5 seconds).

These fast transaction speeds on the XRPL are a great compliment to the built-in order book for facilitating real-time trading. Higher volumes of trades can pass through the ledger, which is essential for keeping prices up to date, especially during periods of high trading activity.

Tokenizing Assets on the XRPL: A seamless gateway to broad trading options

Tokenization on XRPL is a straightforward process which only further enhances the platform’s versatility. For example, you can tokenize a real-world asset on the XRPL with just a single transaction. By tokenizing an asset, you gain access to the fast settlement, broad trading options, and low fees the XRPL is known for just by creating an offer against XRP. In the next lesson, we’ll explore auto-bridging, and its pivotal role in expanding the scope of tokenized assets. By empowering users to trade a diverse range of assets directly and efficiently, the XRPL benefits from increased liquidity and a wider variety of practical use cases.