Lesson 7

DeFi security 101: Staying safe in the new decentralized world

Avoid scams, learn some tips and get a foundation of safety and security knowledge as you explore DeFi projects

When you build or use anything on the blockchain, one of the best things you can do for your business is educate yourself and your customers about common crypto scams.

First, equipping yourself with learning security best practices can help you build a more robust product. It can protect you, your business, and your customers and help you launch projects and make confident decisions.

Let’s discuss what it takes to defend your DeFi project and assets in 2024.

What’s with all the scams?

DeFi is at the center of many news headlines today, and everyone has heard of significant crypto projects such as Bitcoin and Ethereum. Cryptocurrencies are now in apps like Robinhood, and even your parents probably know about Coinbase. With record numbers launching web3 projects, it’s no surprise the headlines are buzzing!

Unfortunately, many news stories center around crypto scams: phishing links, pump-and-dump schemes, and fake NFTs. These stories often scare potential entrepreneurs away from learning about DeFi.

So, what’s with all the scams?

Since cryptocurrencies are designed for anyone and everyone to get involved, there isn’t as much regulation on the legal and financial side. It’s called decentralized finance (DeFi) for a reason. But we can’t have the benefits of decentralization without also coming to terms with some of its challenges.

When a large corporation or government isn’t there to defend or insure your project and assets, you should take security into your own hands. The good news is it doesn’t have to be complicated.

Born in a security world

The entire blockchain and crypto industry grew from cryptography. Serving as the foundation of it all, cryptography is a concept built to protect communication and information. While crypto scams may be common, we should remember that they exist in a world built with many defensive tools for securing transactions and assets.

For example, blockchains are generally built on an immutable ledger. This means once your data is recorded, it cannot be altered or tampered with retroactively. The ledger maintains trust and transparency within systems to reduce the risk of fraudulent activities and data breaches.

Immutability is just one example of native security built into the blockchain world. But security doesn’t stop on the blockchain. You also need some best practices.

DeFi security 101

The key to maintaining a good baseline of security in DeFi is practicing self-guided security. Keep asking questions, stay vigilant, and take your time before making decisions. Here are a few best practices to keep in mind before getting into a project:

Own your keys to truly own your wallet (instead of storing it on exchanges): Remember that you only truly own your wallet if you have the keys to access it. Crypto assets are safer under your supervision than crypto exchanges.

Use a hardware wallet: The most accessible break-in tool for hackers is the internet. That means one of the best ways to defend your crypto wallet is to avoid storing it online. A hardware wallet is where you store your private keys offline, protecting them from most malicious hackers. With a hardware wallet, lost keys = lost crypto.

Use exchanges for trading, not for storing assets: While it’s sometimes convenient to leave your assets on a DeFi exchange between trades, it’s more risky. To reduce that risk, after you’ve finished making your exchange, you can move your assets back to your wallet for safe keeping. If you do use an exchange, make sure to use secure passwords and multi-factor authentication to reduce the chance of your account being compromised. Remember, exchanges like Coinbase are managed by third parties via a software wallet on the internet. You must trust the exchange to control your keys, just like a traditional bank can access your accounts.

Use multifactor authentication (MFA / 2FA): MFA is a classic cybersecurity tool. Using MFA means that accessing your online accounts require multiple forms of identification and verification. This will help keep anyone out who shouldn’t be logging into your account. MFA ensures that even someone armed with your password can’t break into your most important accounts and wallets. For example, a prevalent form of MFA is using email to verify a login attempt is authentic before allowing access.

Use known and trusted DeFi projects and platforms: The cryptocurrency industry is still relatively young, with new projects launching daily. But even in the industry’s short history, strong brands have risen to the top. As a general security rule, it’s best to begin your DeFi journey by limiting engagement with established projects.

Common scams and how to avoid them

Phishing (or “lookalike”) scam: There are many ways to become the victim of a phishing scam. But let’s focus on the most important one for business owners: The website lookalike scam. This is when a scammer creates a website that looks like your business website. When real users try to log in, their credentials are stolen by the scammers.

How to avoid phishing scams

To avoid this scam, be vigilant about not clicking any links from your inbox. Also, always make sure to check your URL bar and ensure you’re on the page you think you are, especially when doing anything involving a login and password.

Pump-and-dump: Pump and dump scams result from individuals and companies making significant financial promises to a niche community, like a celebrity telling you to invest in a new cryptocurrency that you haven’t heard of. After hearing the advice, the community might quickly buy niche coins being promoted (pump), only to watch their money rise promptly and then disappear (dump).

How to avoid pump-and-dump scams

Beware of anyone promising significant and fast returns with little or no risk. These promises are almost always followed by a victim losing money. If you see an online community promising high returns from a specific coin, beware. Do your research, because it may be a pump and dump scheme.

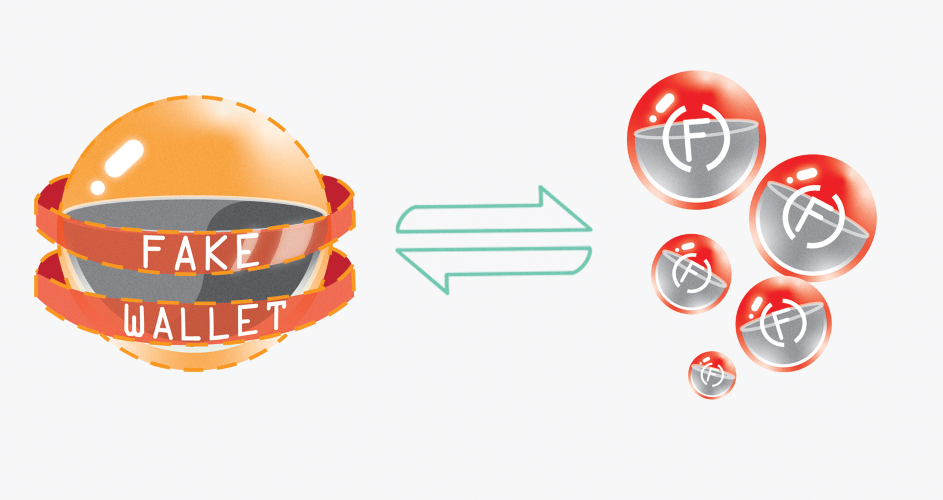

Fake wallets, tokens, and exchanges: This one is pretty self-explanatory. Companies or individuals can create a website pretending to be a trustworthy exchange or wallet entity. Once you sign up, they might steal your information or, worse, your crypto accounts and assets. This goes back to our point earlier about only using trusted DeFi platforms. Blockchain technology has been around long enough that there are now trusted organizations with a long history of providing reliable services.

How to avoid fake wallets, tokens, and exchanges

Aside from using the most vetted services, search for reviews and online discourse about their validity before you try a new platform. It’s hard to hide illegitimate projects from independent review websites. Similarly, you can post to trusted forums or chat groups to get the opinions of other web3 experts.

Pyramid and Ponzi schemes: These schemes promise high returns on investment when you help them recruit new investors—who then recruit more investors, and so on. What may be happening is a classic crypto pyramid scheme.

How to avoid pyramid and Ponzi schemes

Beware of unsolicited offers. If anyone, even the founder of a project, approaches you with an “opportunity,” be skeptical. Also, fact-check the promises of the crypto project. Most pyramid and Ponzi schemes are empty projects sold through a persuasive founder. Do your research. Look for red flags. If something sounds too good to be true, ask yourself: What’s the catch?

Take a security-first approach to exploring crypto

Building a business on the blockchain comes with significant risks and incredible agency. Once you understand the risks and how to avoid them, web3 technology is a compelling new suite of tools for you to use.

Keep exploring, don’t stop asking questions, and stay safe out there!