Lesson 1

How the XRP Ledger can help solve complex traditional finance problems

Unlocking the power of the XRPL for businesses, banking and peer-to-peer settlements

The gap between traditional finance and decentralized finance (DeFi) is narrowing, with each industry offering valuable tools to the other. In today’s economic landscape, they each have many overlapping goals and complementary features.

In web3, we can find a great deal of utility in lightning-fast transaction speeds, modern architecture, and intelligently designed algorithms. Because of these things, solving complicated tasks is a bit easier in the world of cryptocurrency and DeFi. Consider the monumental task of clearing assets and liabilities across multiple banks and customers.

Tracking assets and liabilities natively on the XRPL

Many of the early cryptocurrencies, like Bitcoin, were built on the idea that blockchains track the movement and fracturing of actual coins. Every Bitcoin has a serial number, and it gets broken up whenever a transaction occurs—something called unspent transaction output (UTXO). As the coins are transferred around and split into pieces, the actual origins of those original coins are tracked along through each transaction. If you have half of a Bitcoin, you can actually see that it’s a bunch of change from many of the original Bitcoins.

The XRP Ledger tracks token assets and liabilities as balances, like IOUs, allowing efficient debt settlements. Imagine you owe your friend Brett $1, and your friend Sally owes you $2; instead of using two transactions to rectify the debts, all you need to do is have one transaction where Sally pays Brett $1. This is a core functionality in how the XRPL works, and it really comes into play when we start to have complex financial workflows with numerous entities with overlapping debts.

Collateralized stablecoins function this way as well. Think of the stablecoin issuer as another person (or party) in a multi-party network of debts. Imagine you buy $5 in a USD-backed stablecoin–the issuer now owes you $5 USD. If you are holding these assets on the ledger and owe your friend $5 USD, these debts could be instantly cleared with the XRPL’s native functionality. This is a big differentiator between the XRP Ledger and other cryptocurrencies like Bitcoin or Ethereum, which would require smart contracts to settle/clear the debts.

Simplifying complexity with an on-ledger financial system

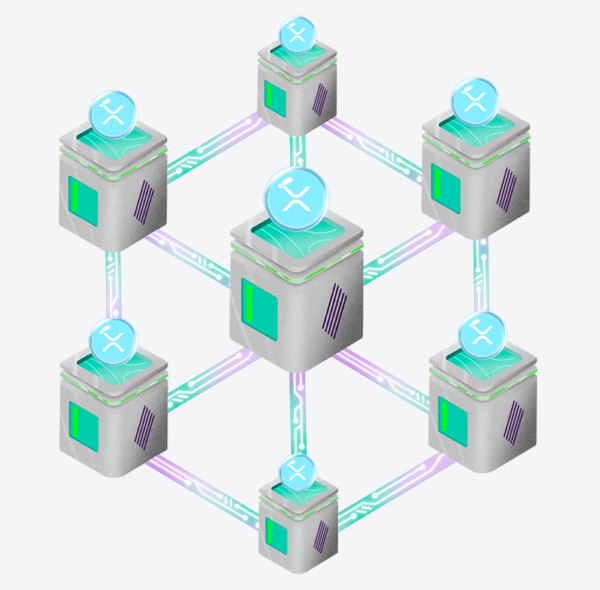

Imagine a group of banks within a city. While banks maintain a balance of lending and borrowing from their customers, they also share these credit lines with each other. Bank A might owe Bank B money, and vice versa. Between all the banks and their customers, there is a massive network of liabilities that is constantly in flux. Although the right amount of money might be in the system to ensure everyone is paid, clearing these assets and liabilities is complicated and prone to human error.

In traditional finance, this complexity is resolved through a highly manual process by humans who can make mistakes. In contrast, the XRP Ledger can automate this process using some of its native functionality. The XRP Ledger was designed to seamlessly settle assets and liabilities across numerous transactions. Like the example of three friends owing each other money, the XRPL can natively settle balances almost instantaneously.

Clearing and settlement are key stages in payment and debt reconciliation. Clearing involves the process of updating accounts and confirming the transaction details between parties. Settlement occurs when the actual transfer of funds takes place, completing the transaction.

Clearing and Settlement

Clearing and settling assets and liabilities across numerous parties is a significant pain point and cost center for banks, businesses, and other financial institutions. Using the XRP Ledger’s distributed ledger technology, financial institutions can automate much of the manual labor currently involved. The ledger’s consensus protocol enables transactions to be digitally signed and validated on-chain, confirming settlements in minutes rather than days. By providing a transparent settlement infrastructure, the XRP Ledger can drastically reduce costs and improve efficiency for businesses and financial institutions. As its settlement capabilities are adopted, it could revolutionize one of the most expensive lines in the finance cost structure.

A brighter, more stable financial future

Now that we’ve introduced how these systems work, it’s easy to envision a future where the fragmentation of payment systems disappears, eliminating errors, delays, and costs. This would create a better and more inclusive financial system, driven by blockchain technology and one of its most important use cases so far: stablecoins.